How I’ll Make Millions With DRIP

- How I’m Going to Become a Multi-Millionaire with DRIP

- TL; DR: Summary of DRIP

- Crash Course: The Basic History of Crypto

- Decentralized Apps (dApps) and Decentralized Finance (DeFi)

- What Is the DRIP Network?

- Too Good to Be True? Tokenomic Analysis for Sustainability

- How to Sign up for DRIP

- Step-by-Step: How to Invest in DRIP Faucet

- How to Top Off Gas (BNB Fees) in MetaMask

- Is DRIP a Ponzi/Pyramid/MLM Scheme?

- Whale Tax Explained

- The Round-Robin Referral System Explained

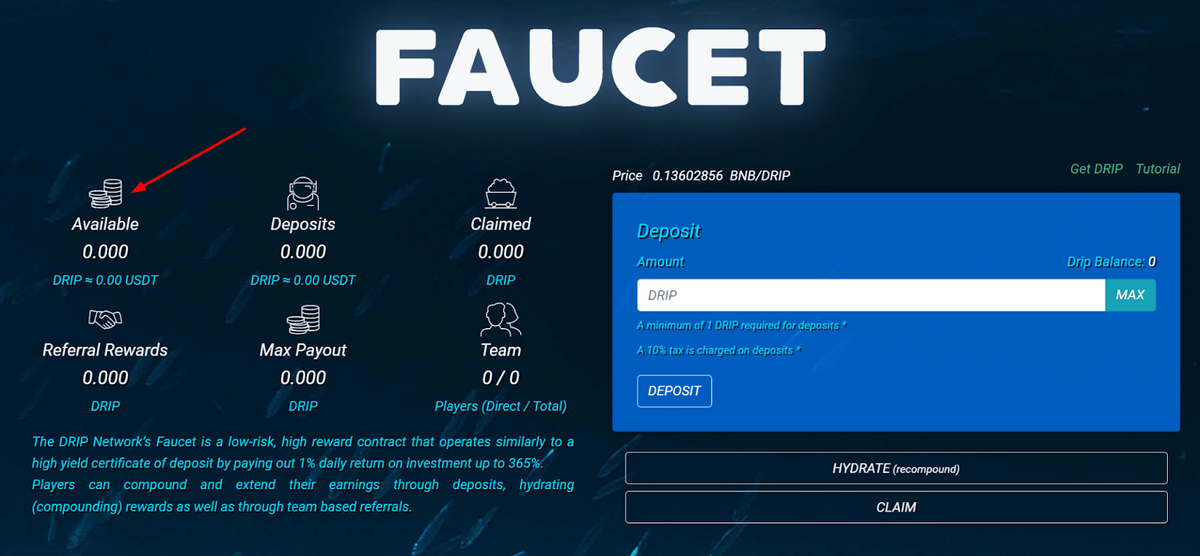

- Understanding the DRIP Dashboard & Stats

- How to Buy BR34P Tokens

- How to Turn Your DRIP Earnings into Actual Cash

- Optimal DRIP Strategies for Regular Passive Income or Max Profits

- Maximize Profits with Multiple Wallet Strategy

- The Risks of DRIP: Is It Sustainable?

- BNB Price Crashes

- Centralized Exchange Freezes

- Doomsday Scenario: What if DRIP’s Price Crashes 99%?

- Conclusion: Your Next Steps

How I’m Going to Become a Multi-Millionaire with DRIP

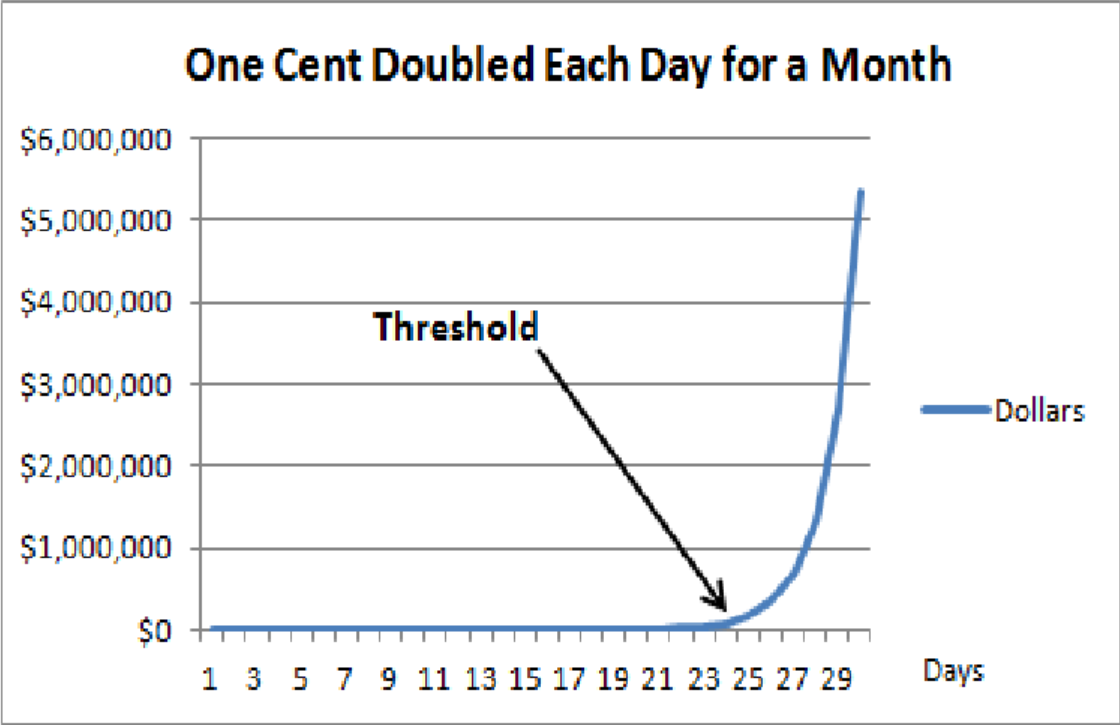

If you were offered either $5,000,000 USD or a penny ($0.01) that doubled in value every day for the next 30 days, which would you pick?

At first thought, $5M might seem like a far better deal, but if you do the math, the penny turns into $10.737M. That’s more than DOUBLE the $5M—an insane $5.737M more!

$0.01 * 2^7 days = $1.28 (Dollar Store, anyone?)

$0.01 * 2^14 days = $163.84 (better but still not much)

$0.01 * 2^21 days = $20,971.52 (exponential growth, baby!)

$0.01 * 2^29 days = $5,368,709.12 (aaand we’ve surpassed $5M, but wait! There’s more!)

$0.01 * 2^30 days = $10,737,418.24!!! ($5.368M gain in a single day!)

The penny’s daily doubling doesn’t amount to much in the first 3 weeks, but in the final days, the amount skyrockets. By the end of Week 2, you’d only have slightly over $163.84. By the end of Week 3, you’d have almost $21k. But on Day 30, you’d gain $5.368M in that ONE single day alone for a grand total of over $10.7M!

That’s the power of compound interest. Albert Einstein once declared compound interest the Eighth Wonder of the World, but the important part of his quote was this: “He who understands it, earns it; he who doesn’t, pays for it.”

So if you didn’t understand compound interest and chose the $5M lump sum, you’d be $5.737M poorer. If you understood, you’d have $10.737M in the bag.

$10M is life-changing money for just about anyone, but earning it is a pipe dream, right?

What if I told you it’s not only possible but extremely plausible? Yup, making $10M in a few years is actually realistic—with the cryptocurrency project known as DRIP Faucet, which earns you 1% daily interest. If you compound that 1% with DRIP, you can turn a small investment—$5k, $1k, or even just $100—into multiple millions in 2 to 5 years.

Too good to be true? Ponzi/Pyramid/MLM scheme? Unsustainable, so time to run for the hills?

Before you hit that emergency eject button, let’s analyze DRIP’s mechanics and the game theory that makes this all possible. No, it’s not risk-free, but it’s low-risk in my opinion. The risk/reward ratio is simply too good for me to pass up.

DRIP even convinced a literal ex-NASA rocket scientist, Dr. Kelly Snook, to invest after she ran extensive calculations. She’s projected to comfortably make 6-figs in her first year of DRIP and 7-figs in her second year (more on her later; her spreadsheet calculator is pure gold).

With compound interest, you barely have to invest anything to achieve true financial freedom and join the one-percenters (the extremely wealthy).

Now, you won’t become a millionaire overnight with $5k or even $50k. It’ll still take years, but single-digit years—not decades—before we can reach 7-8 figures with DRIP.

So what exactly is DRIP Faucet? It’s a low-risk decentralized finance (DeFi) protocol that operates on a cryptocurrency blockchain. Its 1% daily compounding interest mechanism empowers everyday people to realistically become millionaires in a relatively short time (2-5 years).

Intrigued? You can sign up with my referral link so we can both get extra rewards: drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8

TL; DR: Summary of DRIP

The DRIP Faucet is a decentralized finance (DeFi) protocol that lets you earn 1% interest per day on their DRIP crypto token, which you can either claim daily to earn 365% APY or compound (which they call “hydrate”) to create an insane 3,778% APY—and far, FAR more over multiple years.

It’s entirely realistic to turn $1,000 or even just $100 into several million dollars in just 2-5 years, depending on your starting investment. And that’s just in ONE account (called a “wallet” in crypto terms). You can invest a little in as many wallets as you want, which can EACH foreseeably reach several million dollars.

The more you invest in a single wallet, the faster it’ll arrive at the maximum payout allowed, which is the same for every account: 100,000 DRIP tokens (after all of DRIP’s fees/taxes, your actual max payout is closer to 41,670 DRIP, but that’s still worth several million dollars USD at recent mid-March 2022 prices of $60/DRIP).

While such crazy profit sounds too good to be true, the innovative game theory mechanisms and tokenomics built directly into the DRIP smart contract (which is incorruptible because of blockchain’s decentralized nature) actually make such high earnings possible.

Of course, there are some risks, but DRIP has proven itself to be a reputable, sustainable project with over a full year of operations (an eternity in the crypto world, where most projects fail within 1-3 months). It just had its 1-year anniversary on April 22nd, 2022.

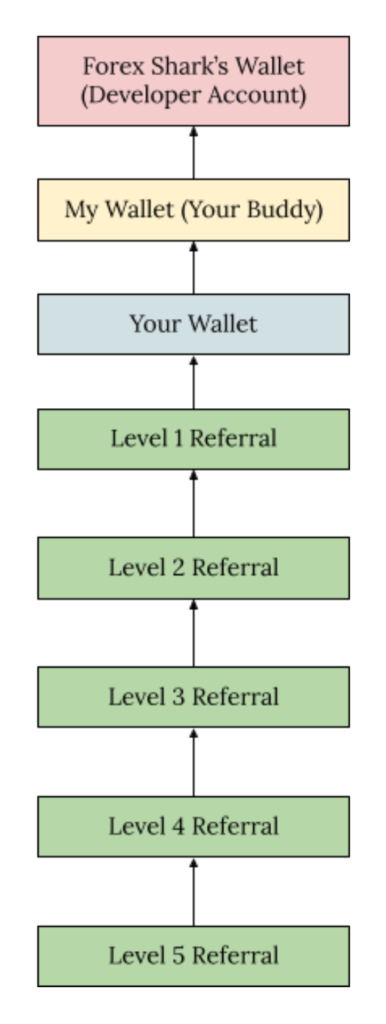

The developer, Forex Shark, has a solid track record of creating many long-lasting projects that have many investors wealthy, and he comes off as a transparent, intelligent, and upstanding guy, so the chances of a rug pull are slim (though of course, not impossible).

If you’d like to invest, DRIP requires signing up under someone’s referral link, which they call a “Buddy Link.” You can use my referral/buddy link HERE so we can both receive extra bonuses (you’ll receive lower taxes and free DRIP tokens).

Here’s my direct referral link: drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8

For step-by-step instructions to sign up, check out my “How to Sign up for DRIP” section below.

The referral element of DRIP often triggers people’s “scam radar,” but that’s because they don’t fully understand how DRIP actually works. The core product of DRIP is NOT a Ponzi/Pyramid/Multi-Level-Marketing (MLM) scheme because it offers every investor—even those with no referrals—the same 1% daily compounded interest rewards. If you prefer to invest in DRIP as a single person and invite absolutely no one, you will still earn the same returns promised (1% daily compounded interest).

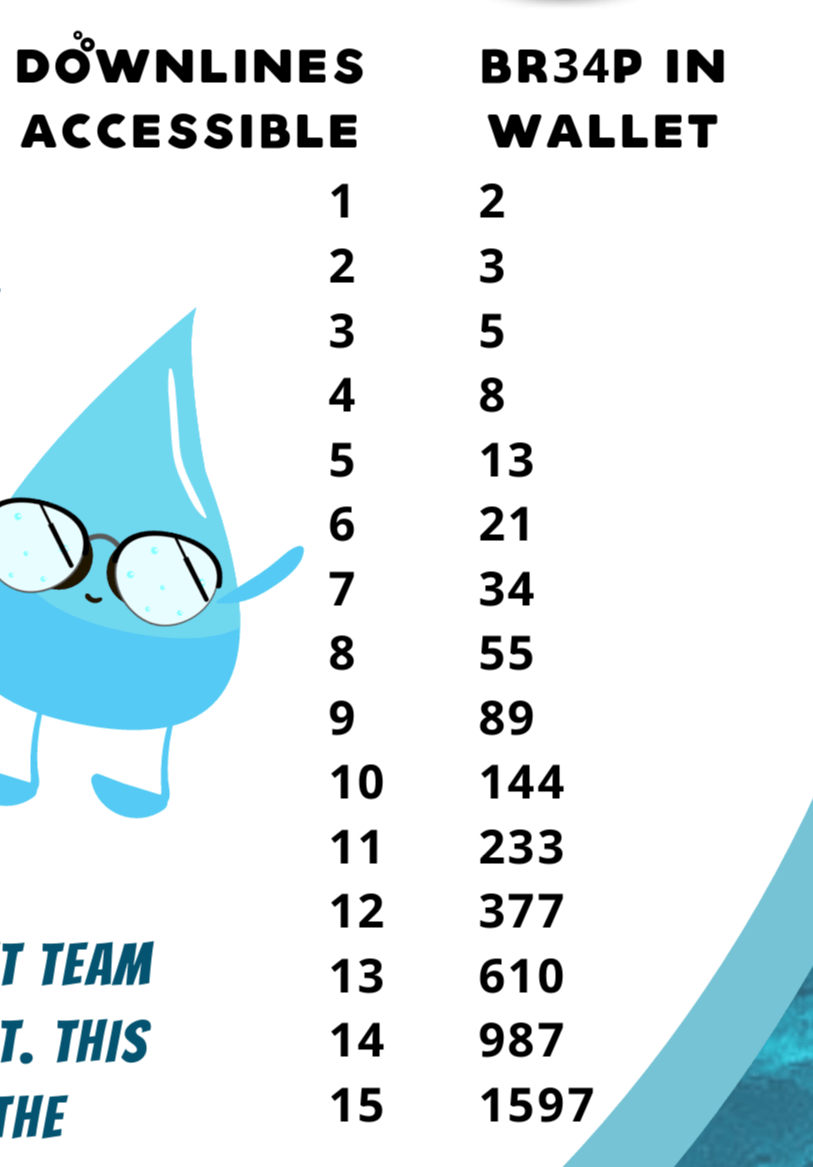

The referral system is a completely separate system from the core DRIP investment. Every transaction within the DRIP Faucet (such as depositing, claiming rewards, and selling) incurs a tax, which is used to pay investors earnings and referral rewards. Under the referral system, referrers earn a percentage of each referral’s deposit and of the deposits of referrals under them (up to a certain level if the referrer holds enough special BR34P tokens).

But unlike in true MLM schemes, the deposit reward going to your referrer is not split among a long upline of multiple people above your referrer. It only goes to your direct referrer, so the buddy link functions like a typical affiliate link. That’s a common marketing incentive to encourage sign-ups. These referral rewards do NOT affect the core DRIP promise of receiving 1% daily compounded interest whatsoever. Instead, referral rewards only sweeten the deal by helping you earn faster, but not earn more (because everyone regardless of referrals has the same maximum earning potential in DRIP).

Furthermore, anyone who has 5+ direct referrals automatically forms what’s called a Team Wallet, which actually decreases referral rewards by 25%. Signing up under a Team Wallet like mine activates an automatic airdrop (i.e. free gift) to return some of your tax back to your wallet. I have no say in this matter because the DRIP contract forces me to give back that amount to you, which means you’re effectively being taxed 22.5% lower than normal. Thus, signing up under a Team Wallet like mine immediately and continually benefits you because all your future transactions are effectively taxed lower.

It’s completely up to you if you wish to further refer to earn your own referral rewards or not. Your choice does NOT affect your 1% daily compounded interest in any way, so you could just refer no one. Even without referring anyone, you’ll likely be a (multi) millionaire if DRIP lasts a few more years. If some unforeseen black swan catastrophe occurs, you’d still likely profit many thousands (probably 6-figures in a realistic doomsday scenario).

None of this is financial advice, but as a typically skeptical, highly risk-averse investor, I have invested thousands and thousands of dollars in DRIP. I believe DRIP has all the markings of a medium- to long-term sustainable project, which is enough time to become a (multi) millionaire.

Please always do your own research before investing! Reading this article fully would be a good start.

Crash Course: The Basic History of Crypto

Before you can invest in DRIP, you’ll need a basic working knowledge of crypto and decentralized finance (DeFi). You can skip this section if you’re already aware. If not, here’s a little background to get you ready to invest.

I’m sure you’ve heard of Bitcoin (BTC), the first cryptocurrency ever invented. Just like classic cash (called “fiat money”), Bitcoin is a store of value. But what’s so special about that?

Well, money is really a system of trust. In the past, we placed our trust in something tangible, like gold. Later, when we stopped using gold to back our money, we placed our trust in the government instead. Those numbers in our bank accounts have value simply because the government says they do, and we trust the government to honor its word.

But these days, people are losing trust in their governments, so millions of people are shifting their trust to something else—to technology, which is what cryptocurrencies are (technological money).

Cryptocurrency transactions are recorded by computer technologies called blockchains, which are online public ledgers of transactions that anyone can verify. Blockchains are designed to be decentralized, meaning these transactions are validated (in other words, agreed upon) by millions of people, rather than only a handful of central government agencies or banks, which are more easily corrupted.

With millions of participants all reviewing the transactions and coming to a consensus on what truly happened (such as how much money was transferred, when, and from/to whom), corruption is practically impossible. Thus, the blockchain’s decentralized nature creates immutability, transparency, and unhackable transactions, so the benefits of crypto over fiat money are obvious.

But beyond serving as currency, Bitcoin (BTC) has no other practical utility. So along came Ethereum (ETH), the second cryptocurrency in existence, which expanded the use cases for immutable public ledgers. Instead of merely verifying money transactions like Bitcoin, Ethereum’s blockchain also enabled the verification of computer code transactions.

Suddenly, developers could write computer applications (“smart contracts”) that would execute agreements between parties without fear of corruption. People have no choice but to uphold their end of the deal because smart contracts are entirely automated and verified by the decentralized blockchain. Even if someone wanted to break their promise, the blockchain makes doing so impossible.

A smart contract is more than a stated agreement. It’s also its own enforcer, executing the agreement exactly as programmed in the code itself. Since transactions executed by the contract’s code are validated by a massive number of people or computer nodes, the agreement is essentially incorruptible.

For a hacker to corrupt the blockchain, he would need to simultaneously take control of ALL 25,000+ nodes on the ETH blockchain and do so for every subsequent block on the chain forever. While it’s possible (though difficult) to bring down a centralized network like Google or Facebook/Meta, a sufficiently decentralized network with thousands of validators is virtually impossible to take down. That’s why blockchain is considered incorruptible for all intents and purposes.

Decentralized Apps (dApps) and Decentralized Finance (DeFi)

Although ETH pioneered decentralized smart contracts, the idea has since spread to multiple other blockchains, each utilizing different cryptocurrencies like Solana (SOL), Avalanche (AVAX), and more. On these various blockchains, computer developers have created countless decentralized applications (dApps), which are just like normal iPhone/Android apps, except dApps run on blockchains to ensure decentralization.

dApps enable people to do virtually anything from playing video games to financial investing, but we’re here to discuss money, so let’s focus on that. Using the incorruptible nature of blockchain, developers have created numerous decentralized finance (DeFi) protocols that attract many people to invest their cryptocurrencies.

So what’s the difference between investing in crypto and DeFi? Well, technically, crypto is a type of DeFi, since crypto is a digital, decentralized coin.

But when most people say they’re investing in crypto, they mean they’re trying to buy the coin at a lower price and hopefully selling it later at a higher price—the same way people invest in stocks. Crypto trading in this manner is similar to stock trading.

However, many people are scared to invest in crypto because cryptomarkets are far more volatile than stock markets, often changing by 50% or more in mere weeks or even days. This has minted many crypto-millionaires almost overnight, but the high risk scares the vast majority of people from dipping their toes into crypto.

Fortunately, many DeFi protocols offer safer, less volatile investment opportunities that can still achieve the same crazy high earnings as basic crypto trading. These protocols are far more sophisticated than simple buying and selling, so the technical nature and mechanisms confuse and intimidate many people. However, in return, you’ll enjoy incredible gains for relatively low risk.

(Important Sidenote: many DeFi protocols are extremely high-risk ventures, straight-up Ponzi schemes, or scams, but many others are not.)

For example, the low-risk Anchor Protocol allows users to earn approximately 19.5% APY on their deposited money. That sure beats the 0.01% you’re earning in your savings account at the bank, but how does 3,678% APY sound? And it can go far higher than that over multiple years.

That’s what the DRIP Faucet DeFi protocol offers—all with relatively low risk. Now, all things in crypto and DeFi are considered risky by traditional standards, but as I’ll explain, DRIP is among the lowest risk DeFi projects with one of the highest returns. The risk/reward ratio is simply jaw-dropping.

Imagine turning $5k into $25M+. With DRIP, this is entirely realistic. A little ventured for a lot gained, which is why many have deemed DRIP a “low-risk, high return” project.

I know. Your Spidey-sense is still tingling. Sounds too good to be true, right?

I felt the same way too, so I’ve spent 50+ hours researching and devouring everything I could about this project. I’m extremely risk-averse and hate losing my money (even $0.50 parking fees and $0.60 almond milk upgrades at Starbucks bother me to no end), so I needed to be more certain before I plopped down my hard-earned money.

After all my investigation, I’ve decided to make a major investment into DRIP, but read on and you can decide for yourself. As with any investment, do your own research (DYOR)! Nothing on Discerning Finance is financial advice, but whatever you decide, make your decision before it becomes another case of “I wish I’d bought Bitcoin back then…”

What Is the DRIP Network?

The DRIP Network is a collection of DeFi projects founded by an anonymous developer called Forex Shark. This isn’t necessarily a red flag because countless people choose to be anon in the crypto world, given that privacy is part of crypto’s core appeal. Within the DRIP Network, Forex Shark has launched numerous projects like the DRIP Garden and Piggy Bank, but his signature (and, in my opinion, safest and most sustainable) one is the DRIP Faucet, which is the focus of this article.

The DRIP Faucet allows investors to earn 1% daily interest on their deposited money, which can be compounded to insane returns.

You can deposit basically any amount you want into the DRIP Faucet protocol (the current minimum deposit is low, 1 DRIP, which has recently fluctuated between $30-60), which you immediately burn and will never get back.

However, every 24 hours, you will receive rewards of a fixed, non-variable 1% of your deposit (minus the taxes that DRIP charges on every transaction to stay sustainable.)

If you claimed these rewards for one year straight, you’d have received a 365% APY. After around just 100 days, you’d have broken even (assuming DRIP’s price stayed flat), and everything after that is 100% risk-free pure profit. After 365 days, you’d have made 3.65x your initial investment. All of these calculations are pre-tax (DRIP’s taxes, not the government’s income tax), but even after DRIP’s tremendous taxes, you’d still profit handsomely because compound interest is that powerful.

For comparison, the S&P 500 (a stock index of America’s top 500 companies) only earns about 7-10% a year on average. It was 20-30% during the most recent bull run, but as of early 2022, we’re in a bear market that many believe will last for years.

But after one year in DRIP, assuming no price change, $1k can become $3,650 (pre-DRIP taxes), or $10k can become $36.5k (pre-DRIP taxes).

How do you like them apples? Show me a better deal…I’ll wait.

Oh wait, there is a better deal—a far, far, far better one. It’s the DRIP Faucet itself!

Let me explain. You see, while you could make your nice 365% APY by claiming your 1% every day, that’s not how we’re going to play this game. Not at all. Forex Shark designed DRIP to enable COMPOUNDING—the Eighth Wonder of the World, remember?

Instead of claiming your 1% daily rewards, you have the option to add that 1% reward to your initial deposit. Doing so increases your next day’s 1% amount because now it’s calculating 1% on a higher value! If you compound for 365 days straight, you would receive a mindblowing 3,778.34% APY. That means $1k becomes $37,783.43 now (much more than the previous $3,650).

And another thing—who says you have to stop compounding after just 1 year? In 2 years, that $1k becomes $1,427,587.91!

And yet another thing—what if we did this on multiple accounts (called “wallets” in the crypto world)? If you put $1k each in 5 different wallets, after 2 years, each of them has compounded to about $1.43M. That’s $7.138M in total! And we could keep going higher…are you realizing the massive potential here?

After you reach such a high number, you can choose anytime to stop compounding your rewards and instead claim your 1% daily reward. 1% of $1.43M = $14,275.87 per DAY! If you then claimed for 365 days straight, never compounding again, that’d be over $5.2M!

And if you did that with 5 wallets? That’s $26M! I’m retiring early now—how about you?

That’s what I meant when I made the bold claim earlier that $5k can turn into $25M+.

(Note: Keep in mind, the APYs mentioned above are calculated in DRIP tokens, not USD, so if the USD value of DRIP changes, so does your actual APY in fiat money. If the price of DRIP doubles, then your APY doubles to 730%. If the price of DRIP halves, then your APY halves to 182.5%.

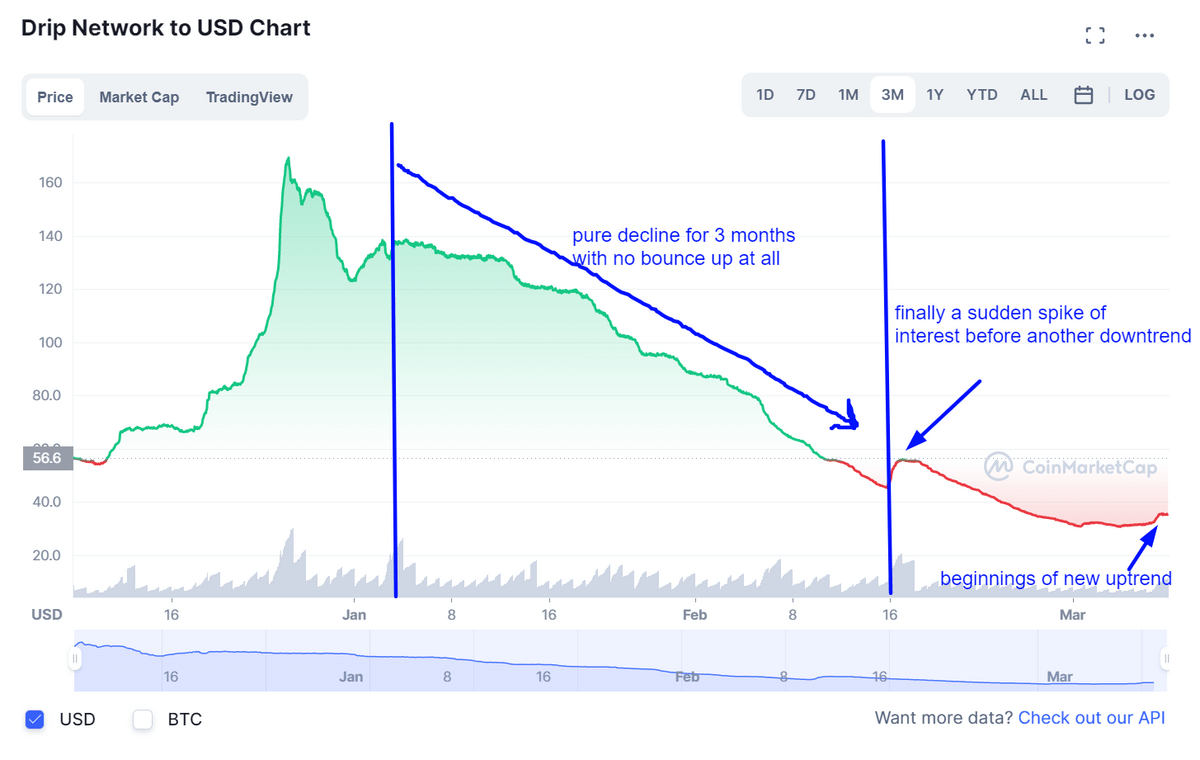

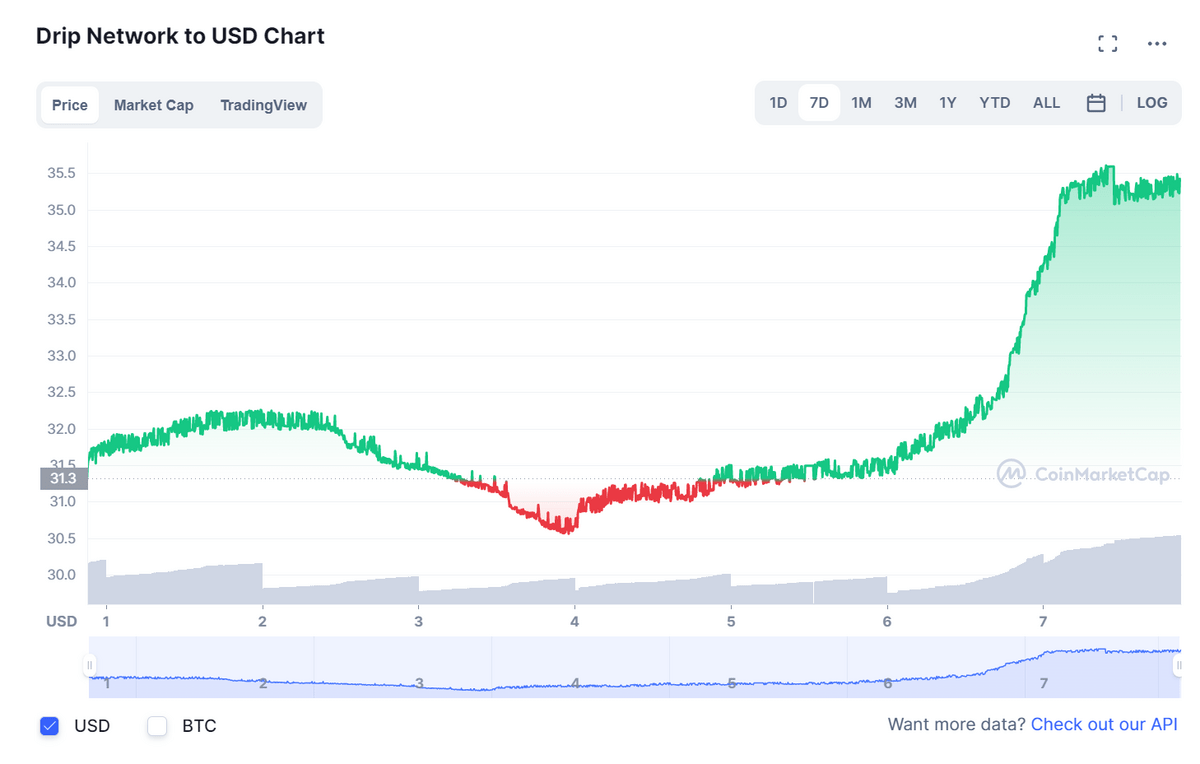

However, Forex built in many mechanisms designed to encourage the price of DRIP to generally increase. I’ll discuss those in detail later. DRIP’s price doesn’t always increase, and we’ve actually been on a steady downward trend for quite some time because of external factors, but the protocol itself created DRIP as a deflationary token, which helps drive prices up.)

Too Good to Be True? Tokenomic Analysis for Sustainability

Before you say that’s too good to be true, consider that there must be good reasons why 100,000+ people have invested so far. DRIP was launched on April 22nd, 2021, and about 10 months later in late February 2022, one user even reached the maximum payout permitted by the smart contract—100,000 DRIP tokens per wallet. That’s worth multiple millions when converted into U.S. dollars. And he has multiple wallets!

I’ll admit, these crazy APYs sound utterly impossible. I’m highly skeptical by nature, which is why I missed the Bitcoin train entirely. I initially thought only the early DRIP adopters could possibly receive such massive payouts, which they’d rob from later investors. Classic Ponzi or Pyramid Scheme, right?

Wrong.

First of all, we have to applaud Forex Shark (the DRIP developer) for creating a DeFi protocol that has lasted more than a full year as of this writing in late-April 2022. In the crypto world, one year is considered an eternity.

Most projects fail within 1-3 months, even when the developer wasn’t deliberately scamming investors with a “rug pull” (pulling out the rug from under you by draining all the money out of the protocol into his own private wallet). DeFi projects that last 1+ years are generally considered reputable, proven projects. And Forex Shark has created many of these projects, not just one.

Although he is not doxxed (meaning he hasn’t revealed his real-life identity), his strong track record of multiple successful DeFi projects that have made many people wealthy mitigates concerns about the feared “rug pull.” Of course, a rug pull is still possible but unlikely.

He’s also participated in many AMAs (ask-me-anythings) on YouTube and elsewhere to answer people’s questions. So far, he’s behaving with far more transparency and dedication to the community than most developers.

But good intentions and past track record don’t guarantee DRIP’s sustainability, so let’s look into the mechanics of the project. Forex Shark envisioned a system that would benefit even much, much later investors, not just the early adopters. So I want to analyze why I believe DRIP is a sustainable project at least for the medium term (1-2 more years at least, possibly 3-5+ years).

It has to do with DRIP’s tokenomics, which refers to the economic game theory mechanisms that govern a project’s crypto tokens and how well a project can sustain itself. I don’t know Forex’s detailed background, but the way he’s designed the DRIP Faucet (and indeed, many of his other projects) reveals that he has applied lessons from game theory to help prolong the project’s lifespan.

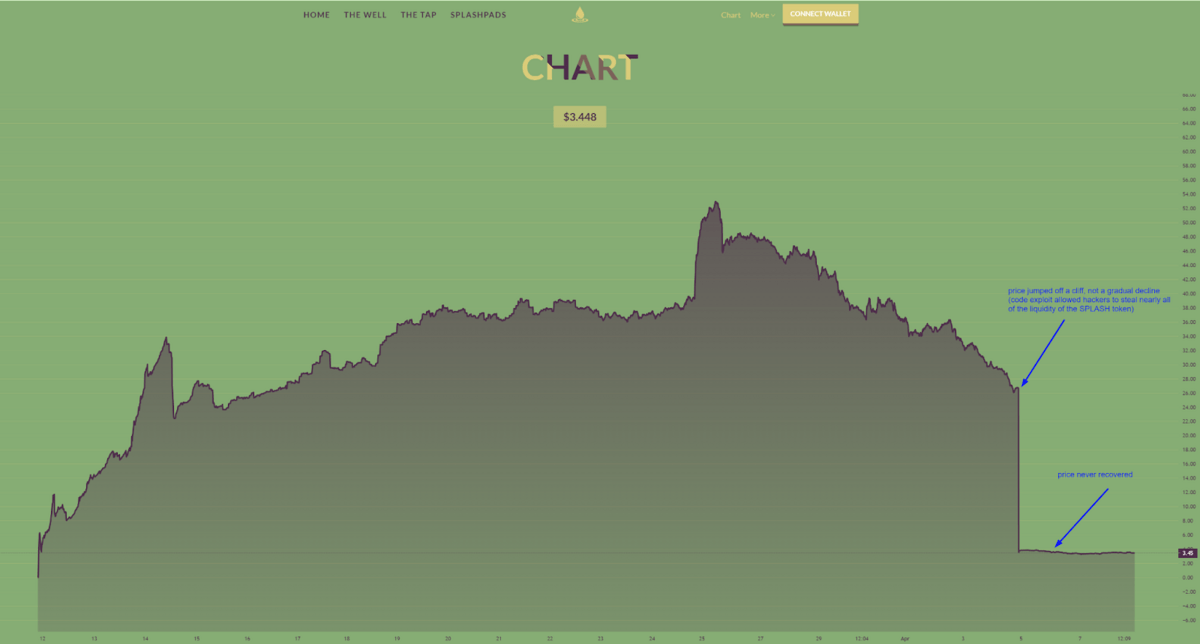

Too many other DeFi projects simply promise insane APYs only to be forced to reduce rewards by 50-90% in a month or two just to sustain. In some cases, the project entirely collapses in weeks, leaving many investors holding the bag and losing their entire investment. Ignoring the deliberate developer scams, even these legit projects fail because their tokenomics had no chance of surviving greedy human behavior.

Forex seems to have studied the tokenomic shortcomings of these other projects and implemented many innovative safeguards to protect against such catastrophic failures.

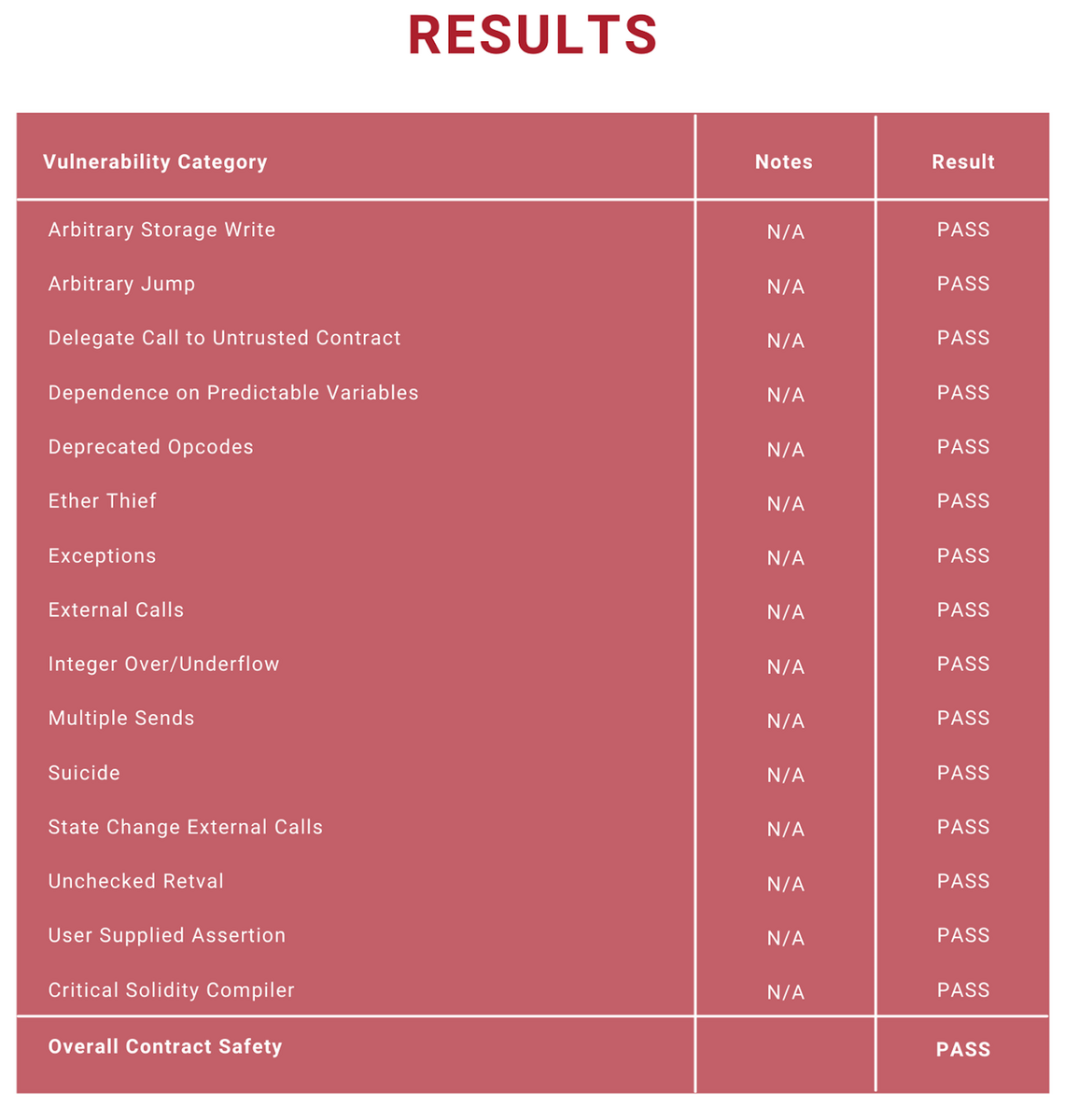

So what are DRIP’s protections?

- Essentially every transaction is heavily taxed to replenish the rewards pool (also known as the tax vault/pool because all rewards are paid from this pool).

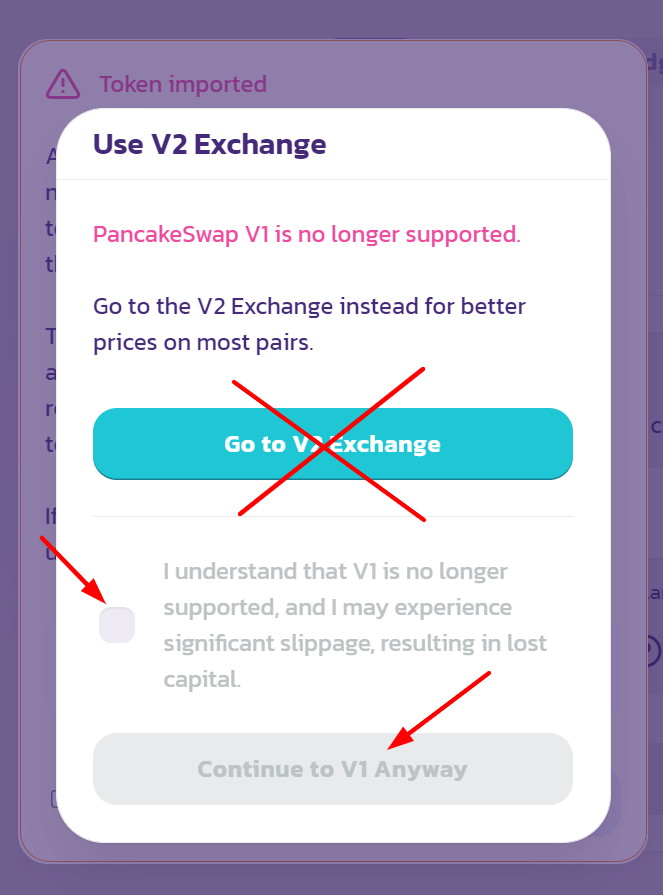

- Buying your DRIP token from somewhere like Pancake Swap (not recommended) costs 10% of your purchase amount unless you buy it directly from the official DRIP Fountain (https://drip.community/fountain), where that tax is waived. 0% tax. This is the ONLY transaction that isn’t taxed in the DRIP Faucet.

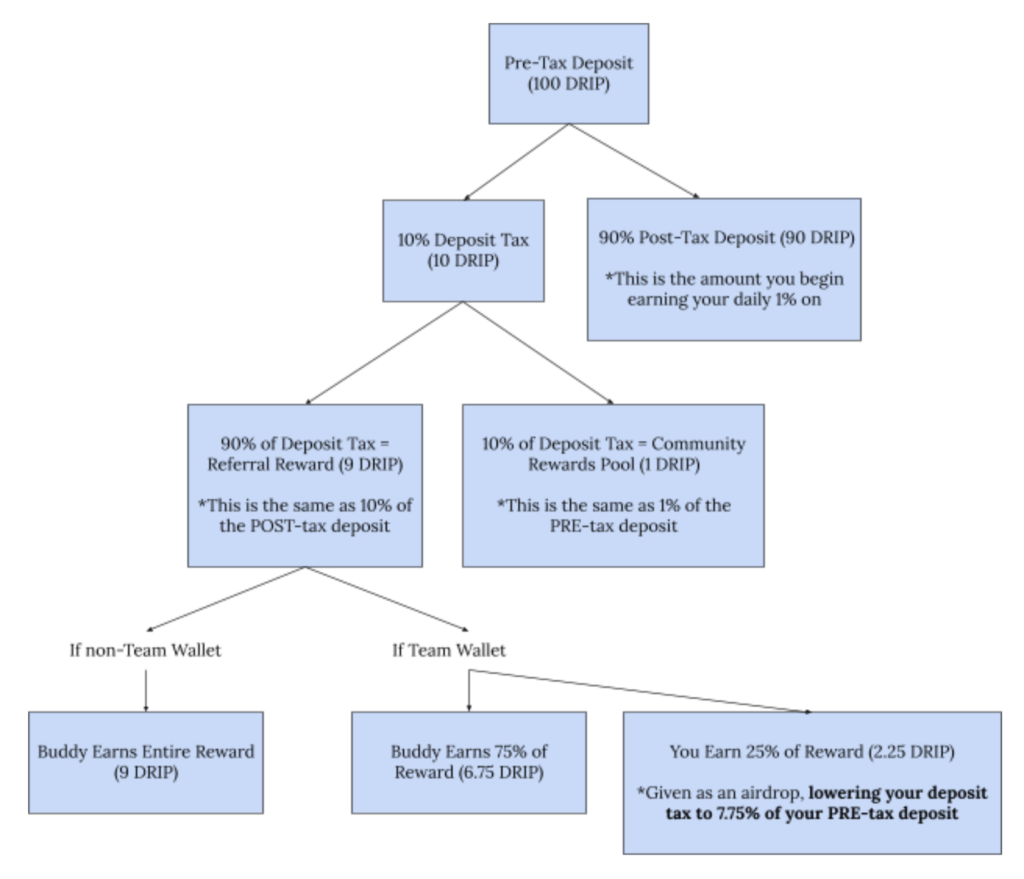

- Your deposits are immediately taxed 10%, which goes into the rewards/tax pool. So you only begin with 90% as your true starting deposit, 10% of which is paid from the tax pool to your buddy as a referral reward. In effect, a buddy/referrer earns 9% of your full original deposit.

- Example: You deposit 10 DRIP into the Faucet. 10% of that, or 1 DRIP, goes into the tax vault, leaving you 9 DRIP as your true starting deposit that your 1% daily interest is calculated from. Your buddy/referral earns a 10% referral bonus on your 9 DRIP (not your original 10 DRIP) worth 0.9 DRIP, which is paid out of the tax pool.

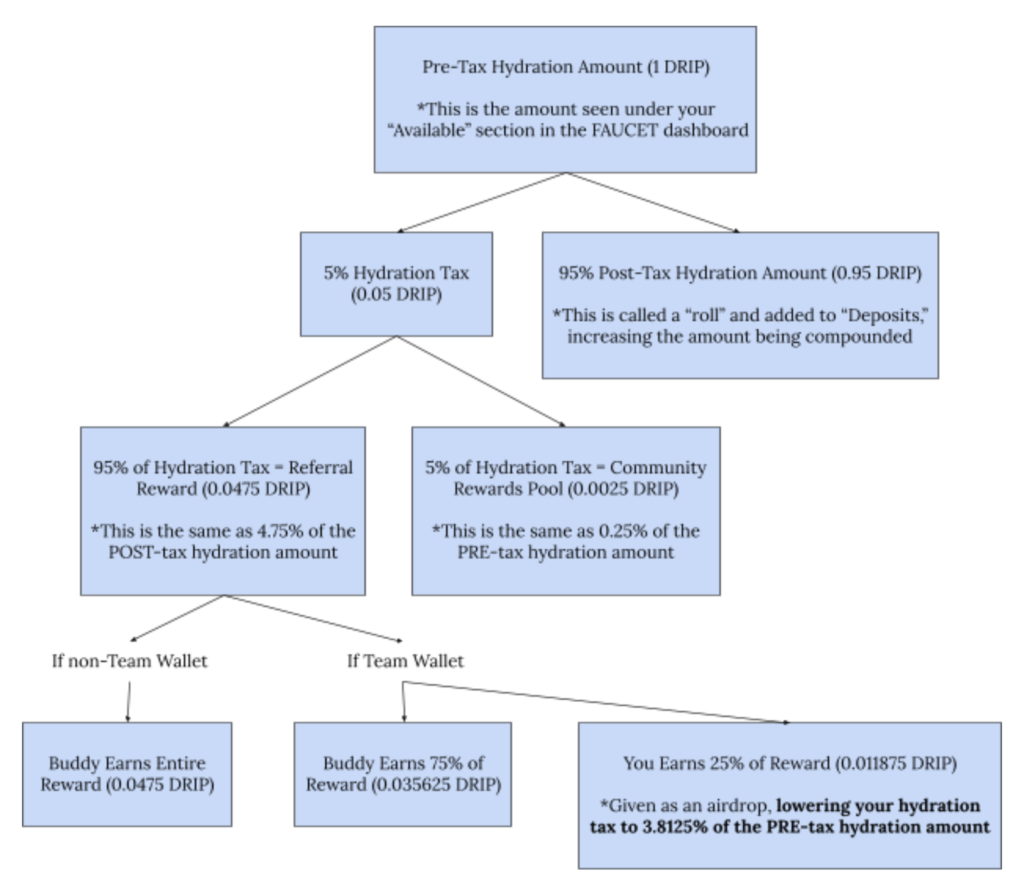

- Every time you compound (which is called “hydrate”), there’s another 5% tax on the compounded amount. So you’re not really compounding a full 1% per day. You’re compounding 0.95% (which is still incredibly good).

- Every time you claim rewards (DRIP tokens), the rewards amount are taxed 10%, so you really only collect 0.90% rewards per day if you claim them, not the full 1%.

- Then when you go to sell your DRIP tokens to convert to cash, you’re taxed another 10% on the amount you’re selling. Combined together with the 10% claim tax, that’s 19% tax on the 1% reward (so you’re really earning 0.81% per day—still very good).

- I haven’t seen any other DeFi project that taxes so frequently and heavily, but these high taxes are precisely what keep DRIP sustainable for the medium-long term.

- Example: You deposit 10 DRIP into the Faucet. 10% of that, or 1 DRIP, goes into the tax vault, leaving you 9 DRIP as your true starting deposit that your 1% daily interest is calculated from. Your buddy/referral earns a 10% referral bonus on your 9 DRIP (not your original 10 DRIP) worth 0.9 DRIP, which is paid out of the tax pool.

- Given how quickly compound interest can reach insane levels, there’s a hard limit of 100,000 DRIP tokens payout per wallet (before subtracting DRIP taxes). This ensures you can’t compound forever and then quickly drain the entire fund for everyone, leaving thousands of people empty-handed.

- You cannot earn more than an absolute total of 365% on the cumulative amount deposited, compounded, and airdropped (which means gifted to you by someone else, not to be confused with Apple’s AirDrop. That has special capitalization in its spelling, but a crypto airdrop does not).

- This means you can’t claim your rewards forever. Once your wallet reaches 3.65x the cumulative amount deposited, compounded, and airdropped, you’re done. That wallet is dead, no longer earning any more rewards.

- The previous two hard limits both apply together. Whichever limit you reach first instantly stops your wallet’s earnings. It’s game over (so hopefully you’ve earned millions by then, which I’ll show you how to do with some optimization strategies in upcoming sections). If you’re claimed less than 100,000 DRIP tokens, then the only way to keep earning more is to buy and deposit more DRIP.

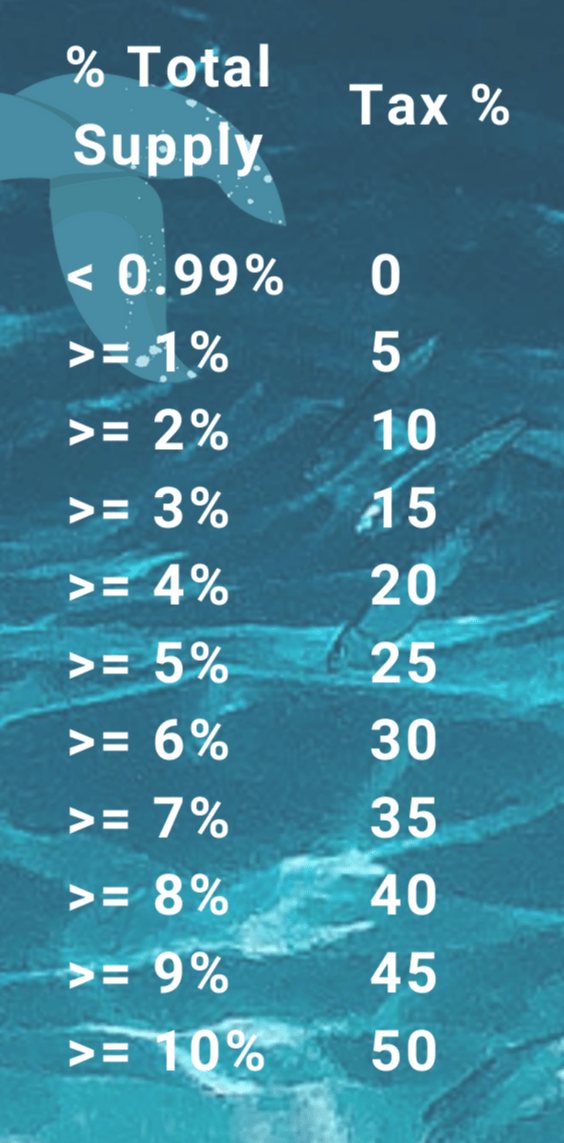

- There’s a heavy whale tax to slow excessive rewards pool drainage. People with huge amounts of crypto are called whales because they’re massive, like actual whales in the ocean. If your cumulative amount deposited, compounded, and airdropped is 1% or more of the total DRIP token supply (currently 1M tokens, so 1% is 10k tokens), you’ll be charged a progressively higher whale tax when you go to claim your rewards.

This tax, which ranges from 5% to 50%, is automatically applied before you can even press the claim button. And you still have to pay all the other taxes previously mentioned, like a 10% claim tax, 10% sell tax, and 5% hydrate/compound tax.

This whale tax mechanism ensures no one, not even whales, can drain the DRIP funds too fast, which has been the biggest problem with many other DeFi projects. Their early investors accumulate massive rewards, then suddenly all cash out at once, leaving later investors with no rewards left. Forex didn’t want that, so the richer you are in DRIP, the more in taxes you pay! Genius.

- DRIP is a deflationary token (which is a good thing in crypto because it drives up prices by limiting or decreasing the token supply). As stated in DRIP’s whitepaper (the official document detailing the project), “Since DRIP [tokens] deposited into Faucet are sent to a burn address and DRIP is constantly being locked in the liquidity pool through the Reservoir contract, DRIP is the only deflationary daily ROI platform.” Currently, there are only 1M DRIP tokens, so as they are burned, the supply decreases, which thereby increases the price per DRIP according to Economics 101. There are other external factors that can lower the price, but at least we have the Law of Supply and Demand in our favor to help boost DRIP’s price.

- These tokenomics help support DRIP’s self-sustainability to keep paying out 1% daily. In the unlikely event that the Faucet contract has run out of DRIP rewards, more DRIP tokens will be minted, so we can’t ever truly “run out.” However, putting more DRIP tokens in circulation drives the price lower. Everything has a balance.

You can read the whitepaper in full on drip.community or here: https://drip.community/docs/DRIP_LIGHTPAPER_v0.8_Lit_Version.pdf

Forex calls it a Lightpaper because it doesn’t explain all the rules in extreme detail, which did leave some confusion, so hopefully this article clears the details up.

If you’re math-inclined, Allisa Auld has performed far more intensive statistical analysis than my abilities allow, and she concluded that the DRIP Faucet is likely sustainable for several more years. That’s enough time to make serious money (at least multiple 6-figs, if not 7- or 8-figs). You can read her analysis in full here (use an incognito browser tab if Medium blocks you with a paywall):

PART 1: https://cryptozoa.com/checking-drip-sustainability-using-statistical-analysis-part-1-c48f79390d1d

PART 2: https://cryptozoa.com/checking-drip-sustainability-using-statistical-analysis-part-2-2edd8284117

How to Sign up for DRIP

If you’re still skeptical about DRIP, I’m glad you like to do your due diligence. You’re a lot like me. I encourage you to study all the risks, even small ones, so check out the RISKS section below. It took me considerable time to run my own risk-assessment before I decided to invest myself. None of this is financial advice, so do your own research, make your own decisions, and be okay with the risks.

If you’re ready to invest in DRIP, follow the steps below. First, DRIP’s contract was designed as an invite-only system, so you’ll need to use someone’s buddy link (referral link) to get started.

If you found this article helpful, I’d love if you used my referral link: drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8

Whoa, whoa, whoa…referral?! Smells like a Ponzi/Pyramid/MLM scheme, doesn’t it?

I thought so too at first. But after studying DRIP for 50+ hours, I saw that unlike real Ponzis, DRIP’s sustainability does NOT rely on a constant influx of new investors in order to pay previous investors. The referral link is just an affiliate link that awards both the referrer and referral extra DRIP for free, but it doesn’t affect the core DRIP Faucet earnings.

The most important thing is that you don’t have to invite anyone—not even one person—to earn your full rewards! This referral system is completely separate from the core DRIP product, so whether you refer 10,000 people or 0 people, you will still receive the same 1% daily compounded interest (same as everyone). You literally do not have to participate in referrals whatsoever!

Everyone is required to pay a 10% deposit tax (taken out of your initial investment) that goes directly into the rewards/tax pool. From there, if your referrer is a Team Wallet (which I am), both the referrer and referral receive a split of that deposit: 75% of the 10% deposit tax to the referrer, 25% to the referral (you).

If you sign up under a non-Team Wallet, you’d have to pay higher taxes. But under a Team Wallet like mine, you’d receive 25% of my rewards credited back to your account. That means lower taxes for you, and lower rewards for me (but that’s okay because I make up for that by having more referrals under me).

So you see, referral bonuses are simply icing on everyone’s cake. Why, then, do so many people get the uneasy feeling that DRIP is a Ponzi scheme? That’s because the referral system looks like a pyramid structure, branching down many levels. Higher level referrers can earn a percentage of the deposits from referrals down several layers. The “upline” and “downline” terminology DRIP uses just seems to trigger people’s Ponzi/Pyramid/MLM scheme radar. But after 50+ hours of deep research, I assure you it’s not.

The crucial difference is that in DRIP, you don’t have to refer a single person in order for you to earn your full 1% daily compounded rewards. This is the complete opposite of real Ponzi schemes, where the top people make exorbitant money while the bottom people lose their investment. In real Ponzis, the only way to earn is to refer more people because Ponzi schemes require continual injections of new cash to pay people higher up the chain.

Not so with DRIP! DRIP has sustained its rewards for a year now through the heavy taxes collected on every single transaction (see the TOKENOMICS ANALYSIS section early), NOT the deposits of new referrals.

Could there be a situation where DRIP’s taxes aren’t enough to cover all the rewards? Yes—that’s one of the risks. But in that unlikely case, DRIP will mint more DRIP tokens to keep paying everyone, so the contract can’t actually “run out.”

Of course, minting more tokens creates inflation, which lowers the value of each DRIP token. However, even if that happens, the power of compound interest allows us to earn such a massive number of tokens that even 90% lower DRIP prices can still make you a tidy profit. Someone even did the math; even if DRIP’s price crashes 90%, you’d still make 7,000x your initial investment given enough time.

Keep in mind, for DRIP’s entire lifetime so far (1 year), DRIP has never needed to mint any new tokens, and there’s no signs that we’re headed towards a situation where we might need to. Things could change, but in my opinion, that seems unlikely.

There are 5 advantages of using my referral link: drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8

- I offer airdrops (free DRIP) to welcome every new referral on my team, as well as random airdrops and targeted airdrops to members most in need of extra DRIP (so I may reward you for having a lower balance). Many referrers offer nothing. This effectively lowers your deposit tax further (paid by me).

- You’ll pay lower deposit taxes, since I’m part of what’s known as a Team Wallet, which means there are 5+ direct referrals under me. The DRIP contract forces Team Wallets to kickback 2.5% of the referral’s starting deposit (that’s after the 10% deposit tax) to the original depositor (you), so instead of paying the normal 10% deposit tax, you’d effectively only pay 7.75%.

You’ll receive this same 2.5% bonus on ALL your future deposits, not just your initial deposit, so you’ll benefit forever by using my Team Wallet buddy link.

Some people incorrectly believe 7.75% should be 7.5%, but no, because your 2.5% kickback is calculated on your post-tax deposit, which is 90% of your full pre-tax deposit. 2.5% of 90% of your pre-tax deposit = 2.25% of your pre-tax deposit, so 10% – 2.25% = 7.75% taxed on your pre-tax deposit. Even though I’d make less per person, I hopefully make up for it by receiving the bonus from more people.

- You’ll pay lower hydration taxes, since Team Wallet buddy links like mine also kickback 1.25% of your post-hydration amount (equivalent to 1.1875% of your pre-tax hydration amount) to your wallet.

Normally, every time anyone hydrates, they’re taxed 5%, which goes to the rewards pool. Then, if they’re NOT under a Team Wallett, the rewards pool sends their buddy/referral 5% of the post-hydration amount (which is 4.75% of your pre-tax hydration amount).

But if you ARE under a Team Wallet, then you receive a bonus: 25% of your buddy’s hydration reward goes back to you, effectively lowering your hydration tax from 5% to just 3.8125% of your pre-tax hydration amount.

You gain these rewards every time you hydrate, so you’ll earn more DRIP in your wallet, which lets you compound faster and receive higher rewards sooner. Given the power of compound interest, these small amounts quickly grow to massive amounts.

- As the Team Wallet leader, I’m here to educate you, clear up any confusion, and help you optimize your strategy. Whether it’s helping you set up your account (crypto and DeFi can be very technically confusing) or consulting you on optimal DRIP strategies, I’ll do my best because it’s in my interest for you to succeed. I’ll even coach you to set up your own team if you’d like. Your success (and mine) helps keep the whole DRIP system more sustainable for years to come.

- I have an extremely short upline with only 1 person above me, so you’ll receive your own referral rewards faster and more frequently. This occurs because of DRIP’s complicated Round Robin referral system design (described in a later section).

So pick a referral link (you can’t start without one), and follow the steps in the next section to begin investing.

Step-by-Step: How to Invest in DRIP Faucet

I’ll start with a high-level overview, then get into the details of each step below.

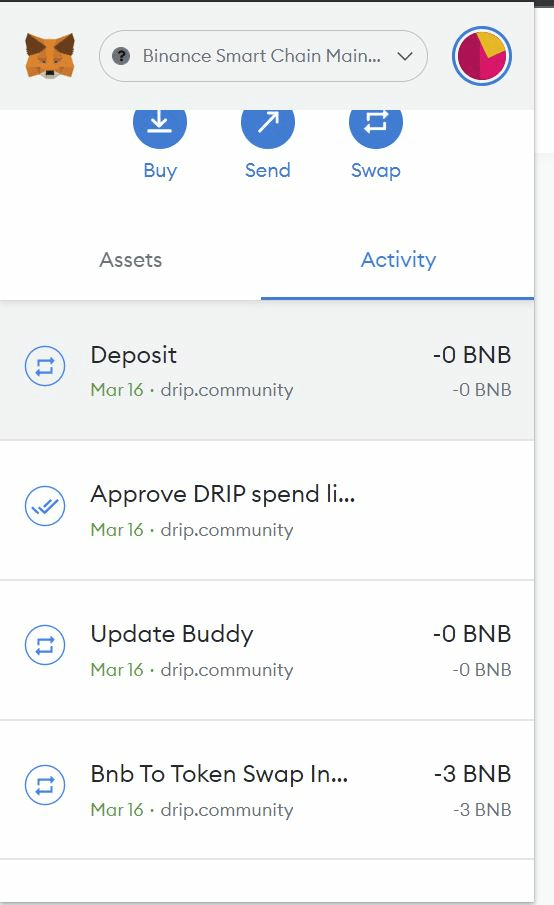

- Sign up for Binance.us (most U.S. citizens) or Binance.com (most non-U.S. citizens), deposit fiat money, and buy BNB (Binance coin), which is needed to convert to DRIP. You can’t directly buy DRIP with fiat money, at least not yet.

- Ensure your BNB is on the Binance Smart Chain network (BSC, also known as BEP20). Do NOT use the Binance Chain (BEP2) or the Ethereum chain (ERC20).

- Install the MetaMask extension from https://metamask.io/download/ and create a new self-managed crypto wallet. Record your password and Secret Recovery Phrase (Seed Phrase) with pen and paper, NOT with digital means that can be hacked (no typing, copy/pasting, or screenshots/photos). Safeguard these secrets carefully, or you’ll lose your coins.

- Add the Binance Smart Chain (BSC/BEP20) network to MetaMask.

- Transfer your BNB from Binance to MetaMask on the BEP 20 (BSC) network.

- Connect MetaMask to the DRIP Faucet at drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8 (my referral link).

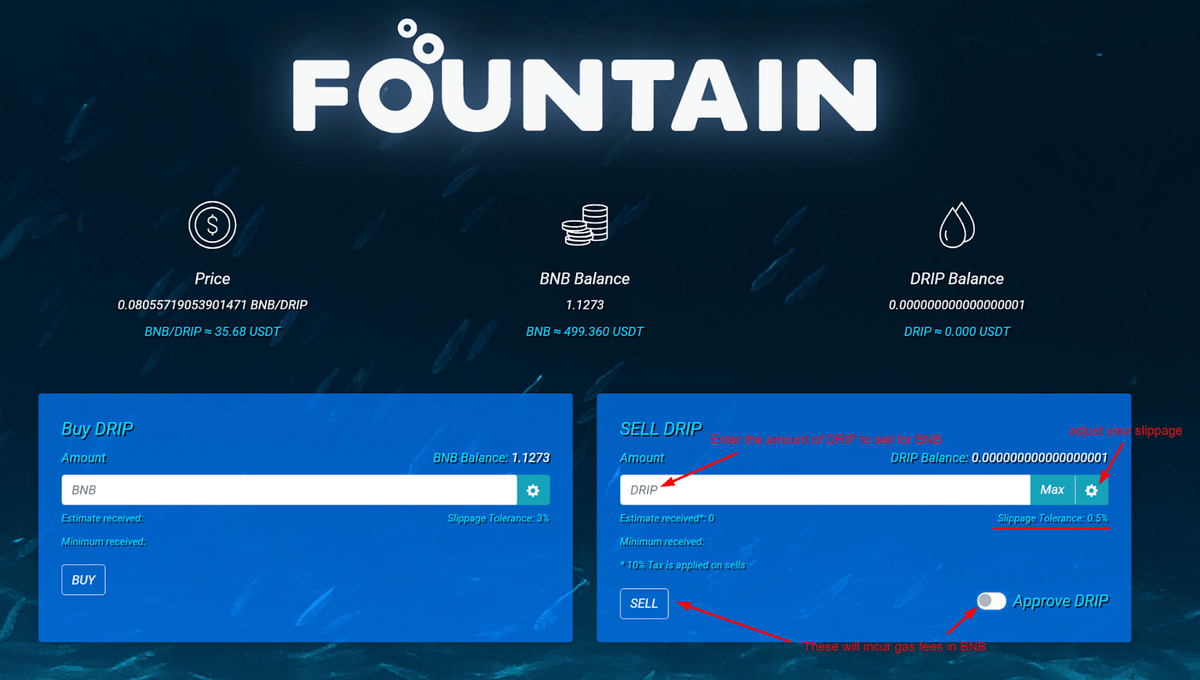

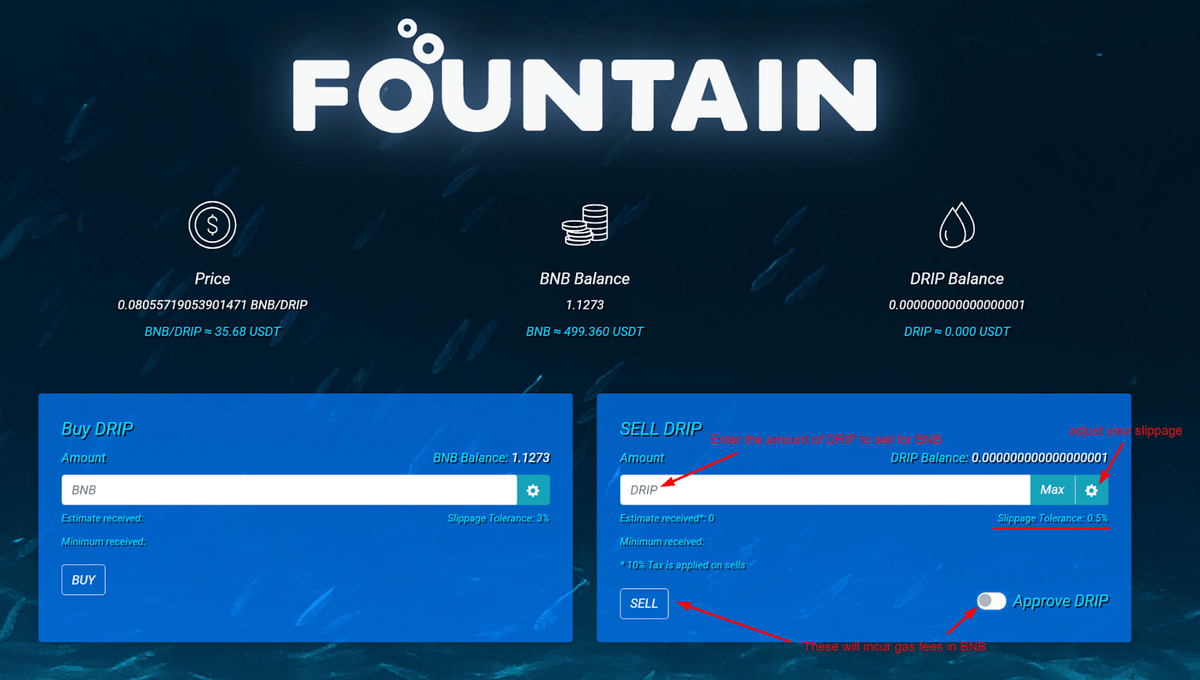

- Exchange BNB for DRIP at https://drip.community/fountain. Manually set a low slippage tolerance like 0.25% to save money (you may need to go higher if you get an error message that says transaction is expected to fail; do NOT waste money on trying to execute then). Make sure to save at least 0.1 BNB to pay for transaction fees. Click BUY.

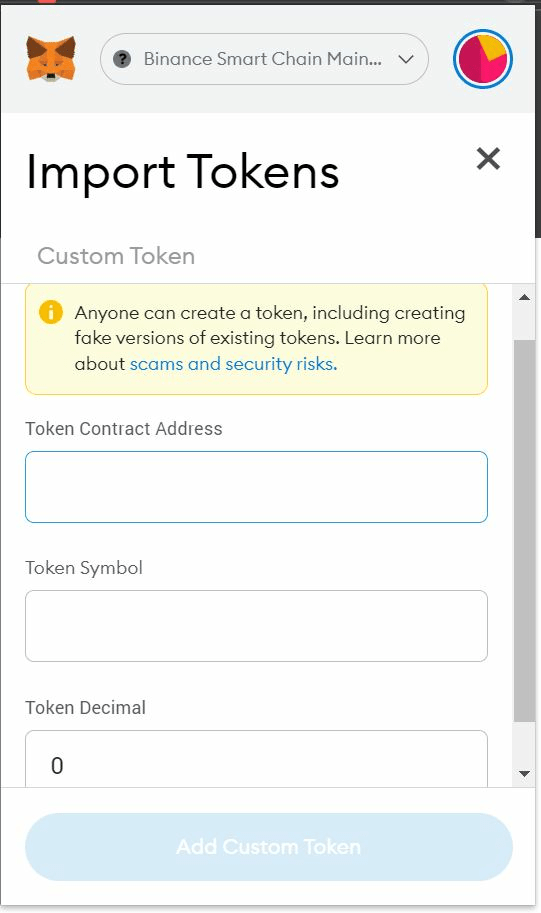

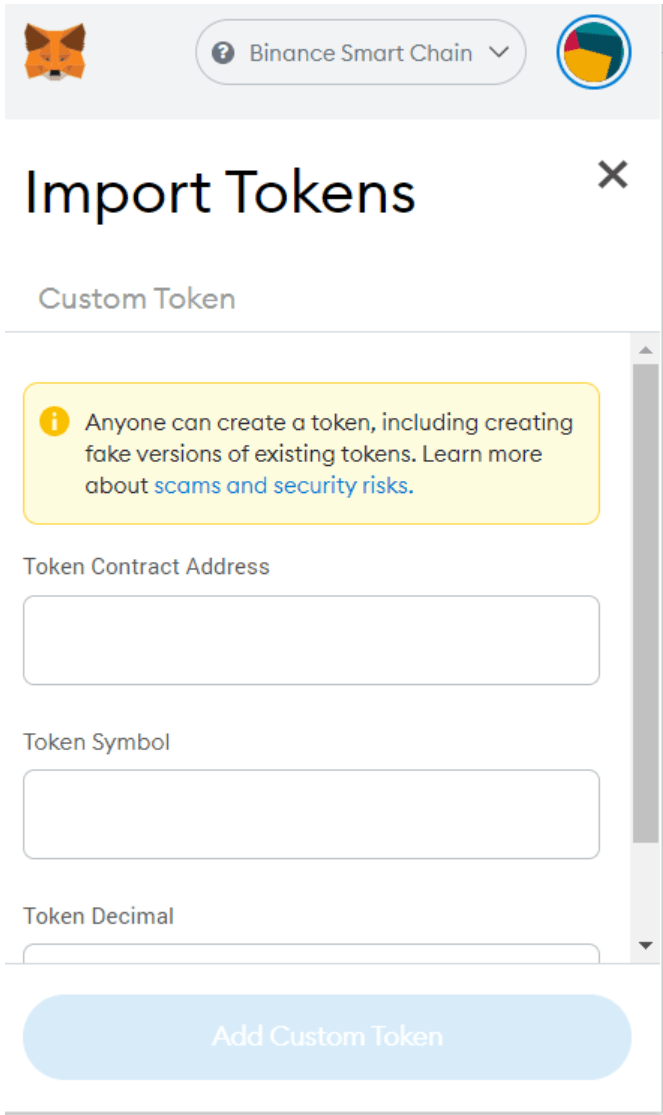

- Import the DRIP token into MetaMask by clicking “Import tokens” and pasting in the following:

- Token Contract Address: 0x20f663cea80face82acdfa3aae6862d246ce0333

- Token Symbol: DRIP (this should auto-populate, or type it in)

- Token Decimal: (this should auto-populate, but if not, type in “18”)

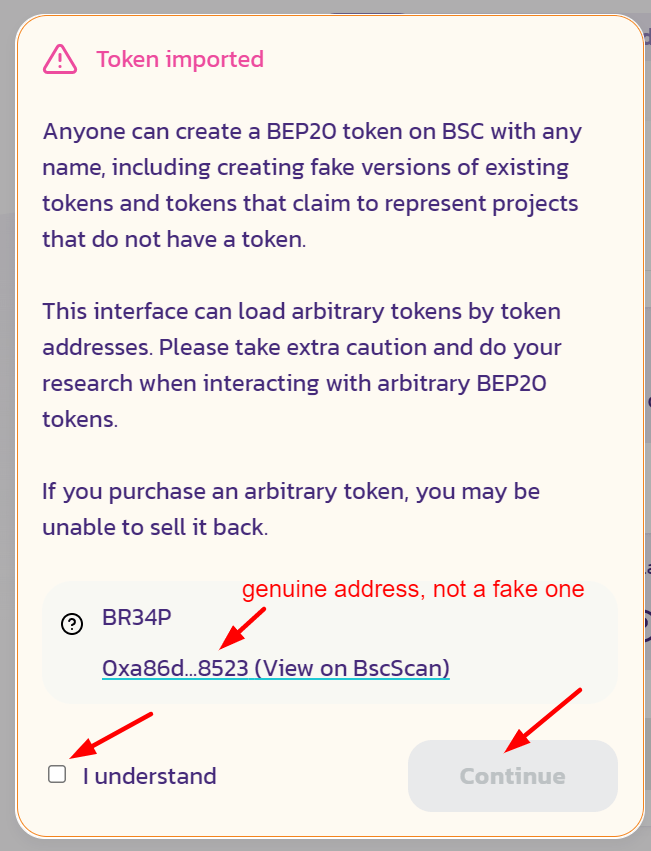

The warning message is to make sure you don’t input fake tokens, so make sure to copy/paste the above settings exactly, which is for the real DRIP token.

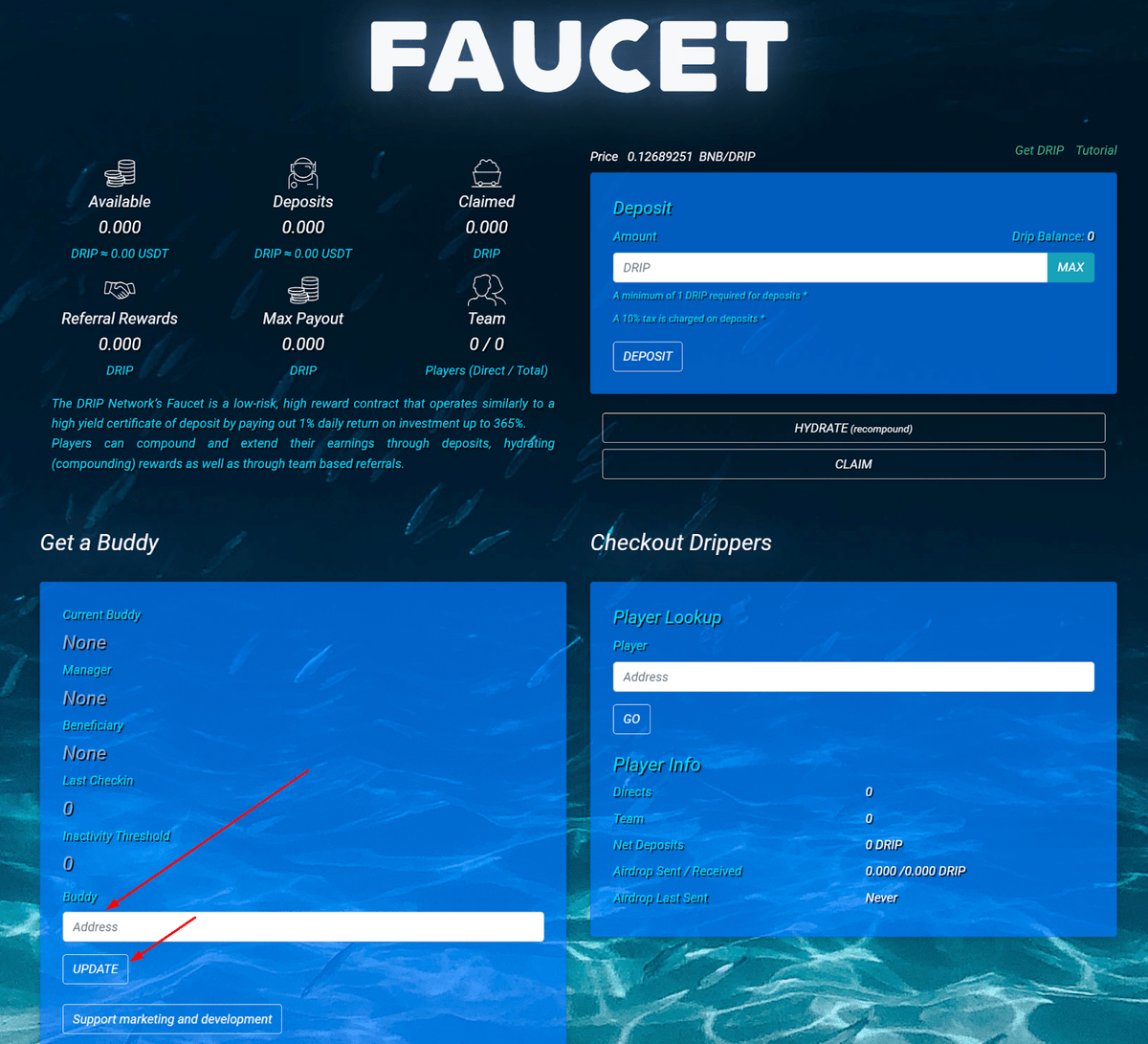

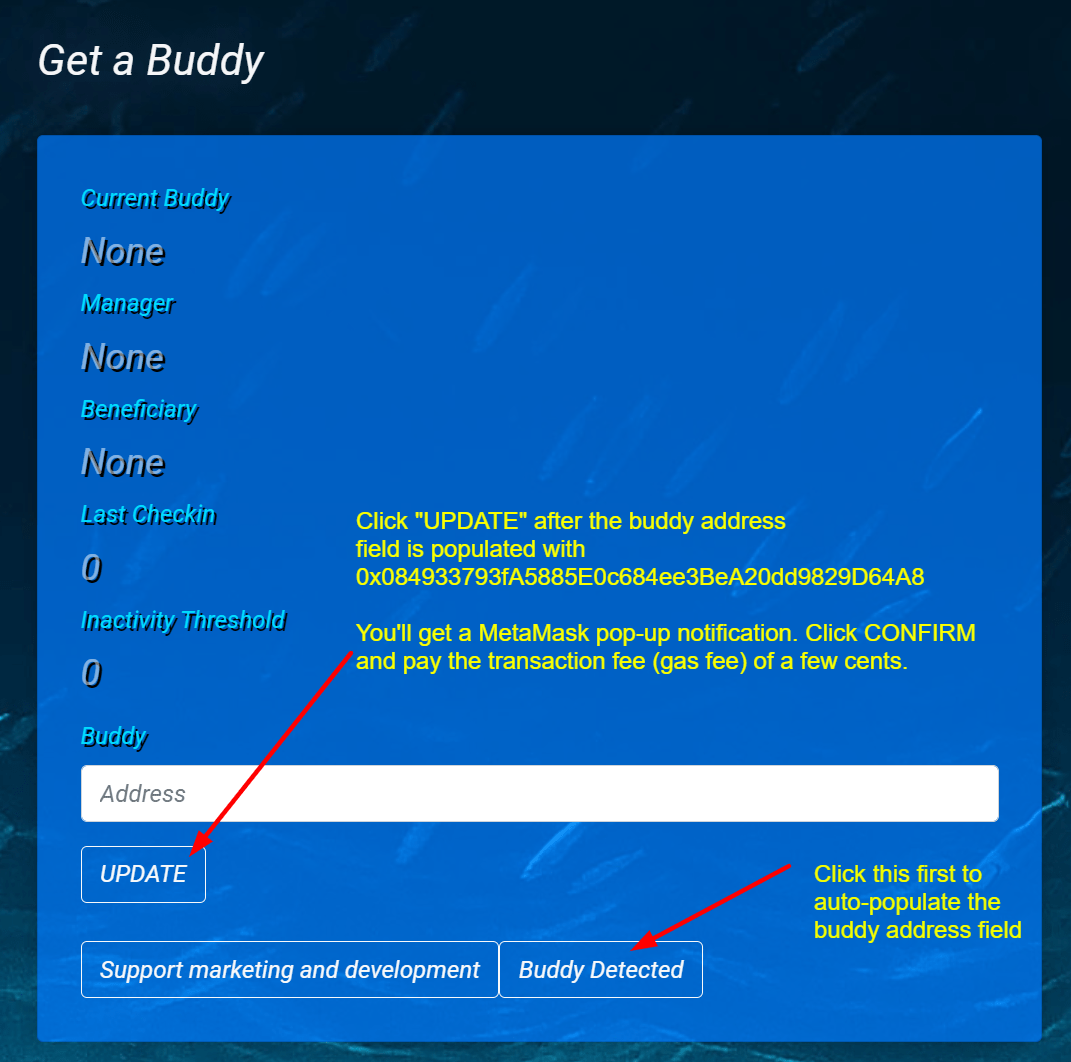

- Go to my referral link (referral is required to join) at drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8andclick UPDATE under the “Get a Buddy” section.(Click CONFIRM on the MetaMask pop-up notification to pay the transaction fee of a few cents)

- In the Deposit box, enter how much DRIP you want to invest (I’d click MAX). A 10% deposit tax is auto-deducted, or only 7.75% if you used my Team Wallet referral link: drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8

- You’re invested! You’ll immediately start earning 1% daily interest on your post-tax deposit and airdropped amount.

- Decide your personal compound/claim schedule to fit your financial goals and timeline. Read my OPTIMAL STRATEGIES section below for detailed strategies.

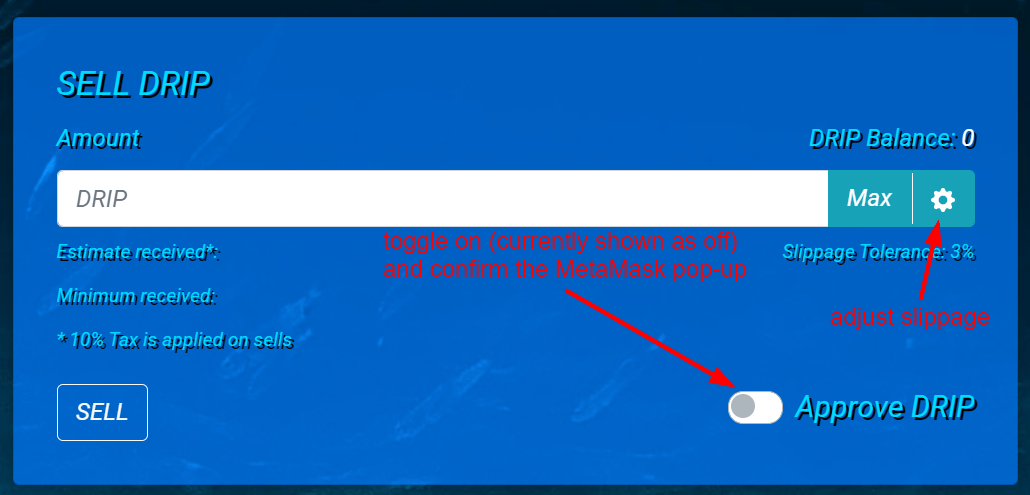

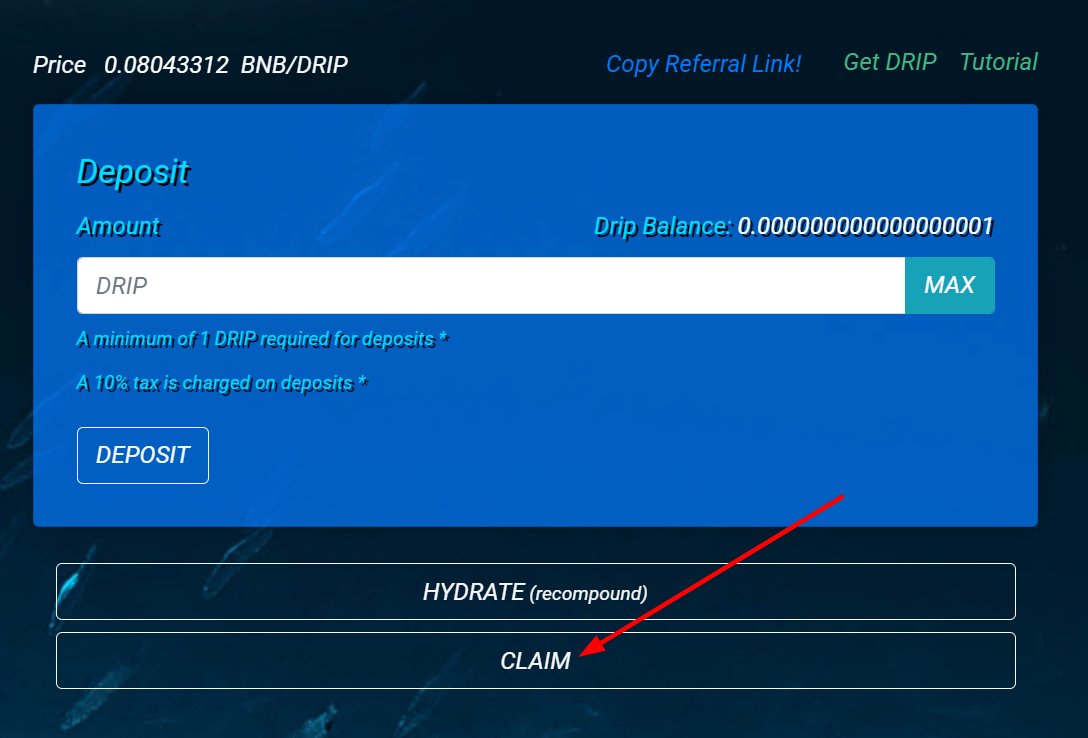

- To sell DRIP rewards for fiat money, you need to first convert DRIP to BNB, then BNB to fiat. Click CLAIM (10% tax) on https://drip.community/fountain, which sends the DRIP into your MetaMask. Then on the DRIP site, adjust the slippage tolerance to 0.1% or something small. Type in how much DRIP to sell and click SELL and toggle “Approve DRIP” on—CONFIRM the MetaMask notifications. Selling costs another 10% tax, which keeps the DRIP Faucet sustainable.

- Deposit/send your BNB from MetaMask into Binance.us or Binance.com using the BEP20 (BSC) network.

- Trade your BNB on Binance for USD, which I suggest keeping at least a portion of inside Binance to deploy for future crypto investments with no waiting period. You could also transfer USD back to your bank now, but if you redeposit USD into Binance, you’ll need to wait 10 days before you can transfer those funds (or newly purchased crypto) out into MetaMask or elsewhere. The price changes in those 10 days can be dramatic, causing you to lose out on opportunities. Good luck!

DETAILED STEPS:

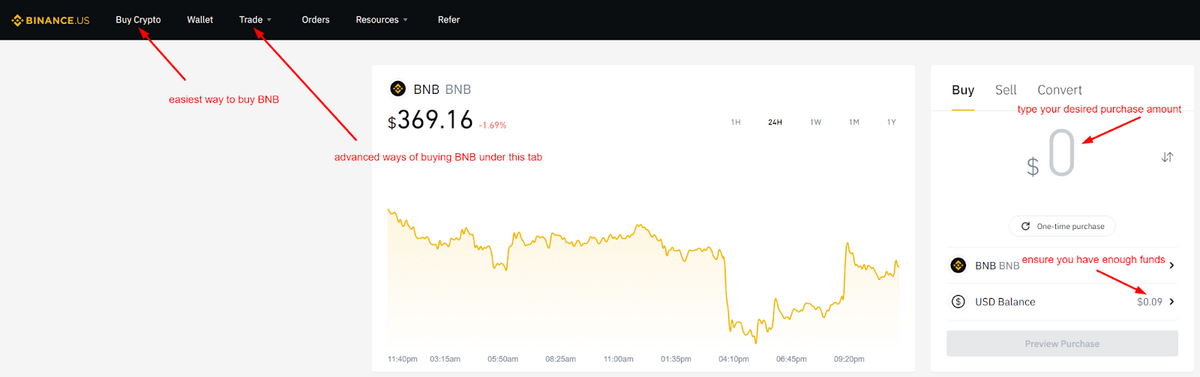

- Sign up for an exchange/platform where you can buy the cryptocurrency BNB (Binance coin), which we need in order to swap for DRIP. Unfortunately, there’s no current way to directly buy DRIP with regular cash (fiat money like USD).

For most U.S. citizens, I recommend Binance.us (not to be confused with Binance.com, which is illegal for Americans). In general, Binance.us is the branch authorized to operate in the States, but some individual states have banned it, so check your local laws. To the best of my knowledge, Binance.us isn’t currently allowed in New York, Texas, Connecticut, Hawaii, Idaho, Louisiana, and Vermont.

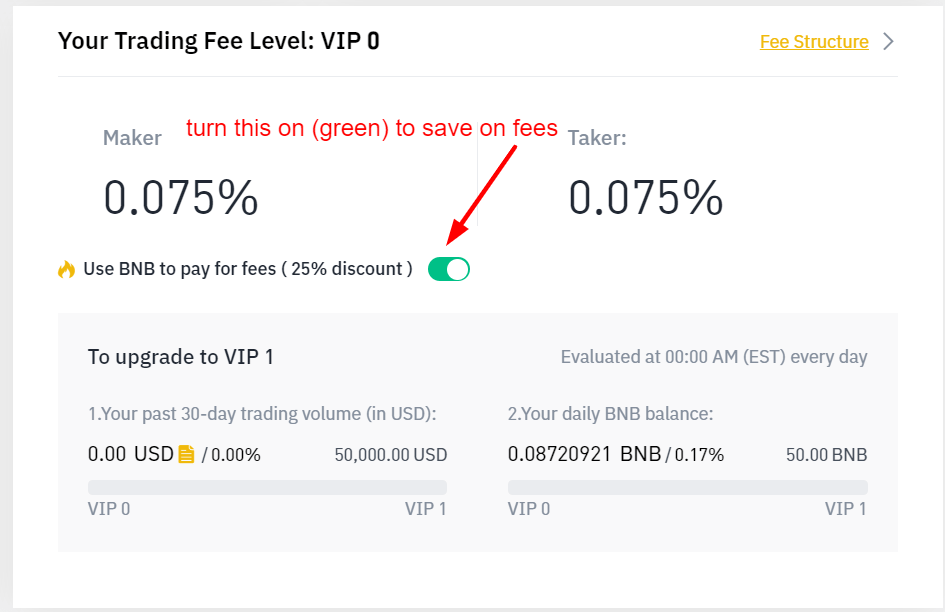

I recommend Binance.us because it has the lowest fees around (0.075 – 0.1% purchase fee) and also because Binance invented the native BNB token.

Many other countries like Australia, Qatar, and the Philippines allow Binance.com, but check your local laws as these regulations may change anytime.

Here’s my referral link for Binance.us: https://accounts.binance.us/en/register?ref=56181632

And my referral link for Binance.com:

https://accounts.binance.com/en/register?ref=56181632

You’ll have to verify your identity by uploading a government ID (driver’s license, passport, etc.) and possibly a recent (within 90 days) utility bill or bank statement that shows your matching address and full name. This verification process is called KYC (know your customer) to help regulators keep people accountable.

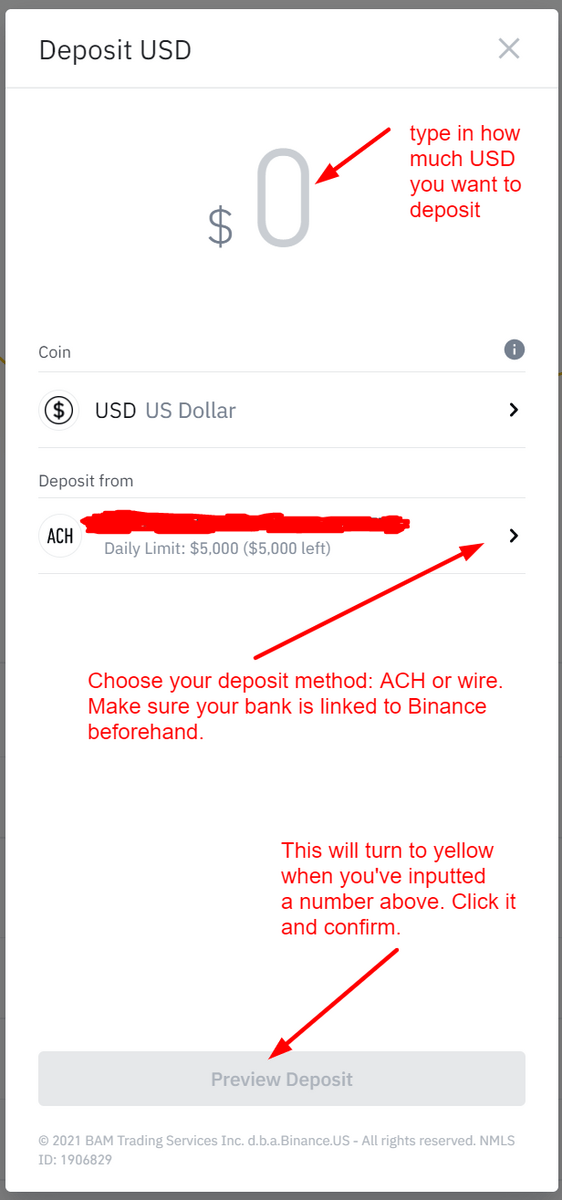

After your identity has been verified, you can link your bank account to Binance and deposit fiat money (e.g. USD) using ACH transfer (up to $5,000 USD daily) or wire (up to $1M USD daily; wire fees are around $30 USD at most banks). There are no deposit fees on Binance.

However, I’ve personally seen a strange bug where Binance rejected a USD deposit for “insufficient funds,” despite there being more than enough funds in the bank. The bank representative verified there were no denied transactions on the bank’s end and that there certainly were enough funds. Luckily, depositing smaller amounts multiple times on Binance until reaching the full desired amount worked.

Detailed instructions for depositing USD into Binance.us for U.S. citizens: https://support.binance.us/hc/en-us/articles/360047428853-How-to-deposit-via-ACH

Detailed instructions for depositing AUD into Binance.com for Australians:

https://binancoins.com/how-to-deposit-and-withdraw-aud-on-binance-via-web-and-mobile-app-0513311

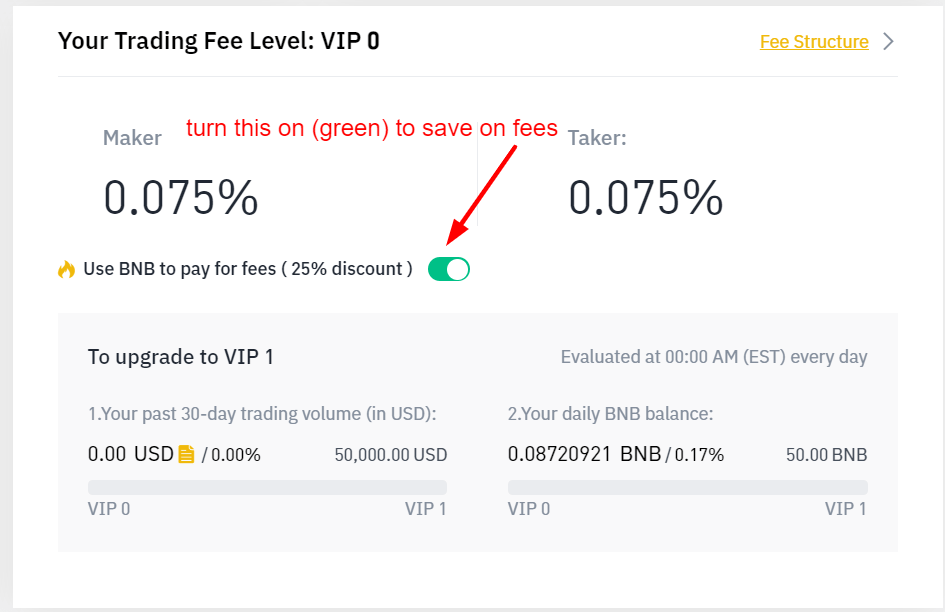

TIP TO LOWER YOUR PURCHASE FEES

From your account homepage, scroll down to the bottom of your dashboard, where you’ll see a setting that allows you to pay the purchase transaction fees using BNB instead of fiat money, which lowers the purchase fee from 0.1% to 0.075% (saving you 25% on fees). Toggle that on so it shows green (see screenshot below).

I recommend keeping $20-50 USD worth of BNB inside Binance.us or Binance.com at all times to cover purchase fees, but the exact amount is up to you. Buying $5,000 USD worth of BNB should cost $3.75 (charged in BNB) or $5 (charged in USD).

PURCHASE BNB

There are two ways to purchase BNB:

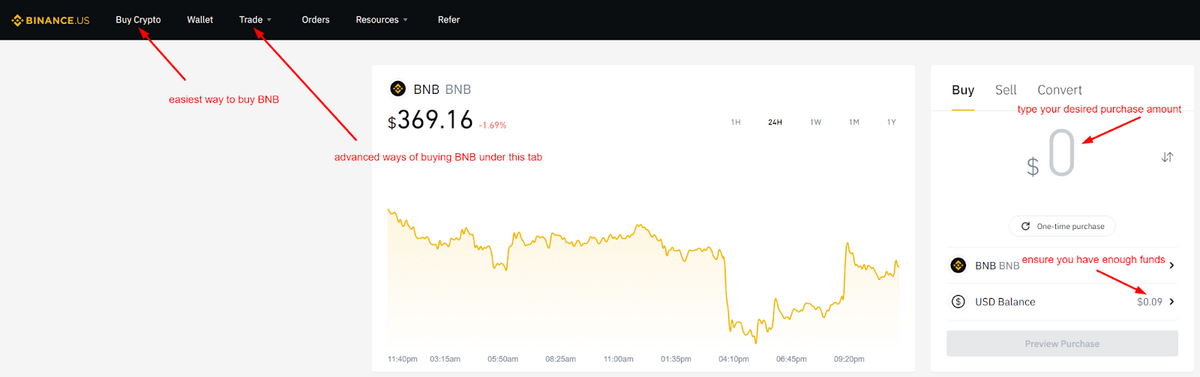

Option 1 (far easier, but 5x more expensive): Instant Buy.

Click the “Buy Crypto” button at the top banner inside Binance after logging in. This is the easiest way, but it’s 5x more expensive at 0.5% instead of 0.075 – 0.1%. See the screenshot below if you prefer this option.

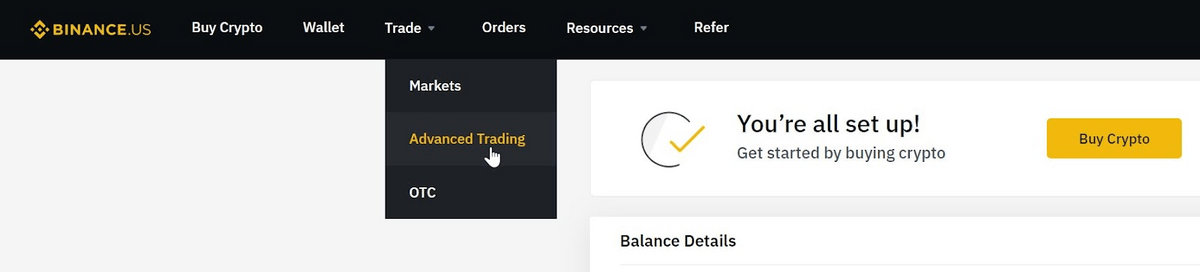

Option 2 (more complicated, but 5x cheaper): Spot Trading.

This method is more advanced but lowers the purchase fees significantly by 5x or more to just 0.1% if paid with USD or 0.0075% if paid with BNB.

Do NOT click the white “Buy Crypto” link from the top banner once you’re logged into Binance, nor the big yellow “Buy Crypto” button. Those are for Option 1: Instant Buy (0.5% fees).

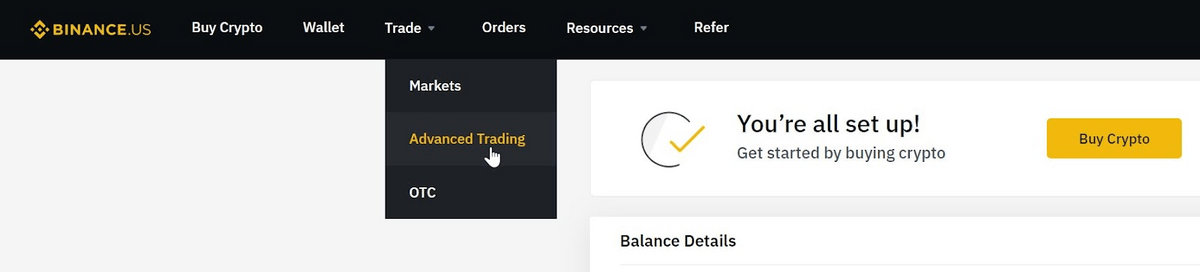

Instead, from the Binace top banner, Click “Trade > Advanced Trading” (see screenshot below).

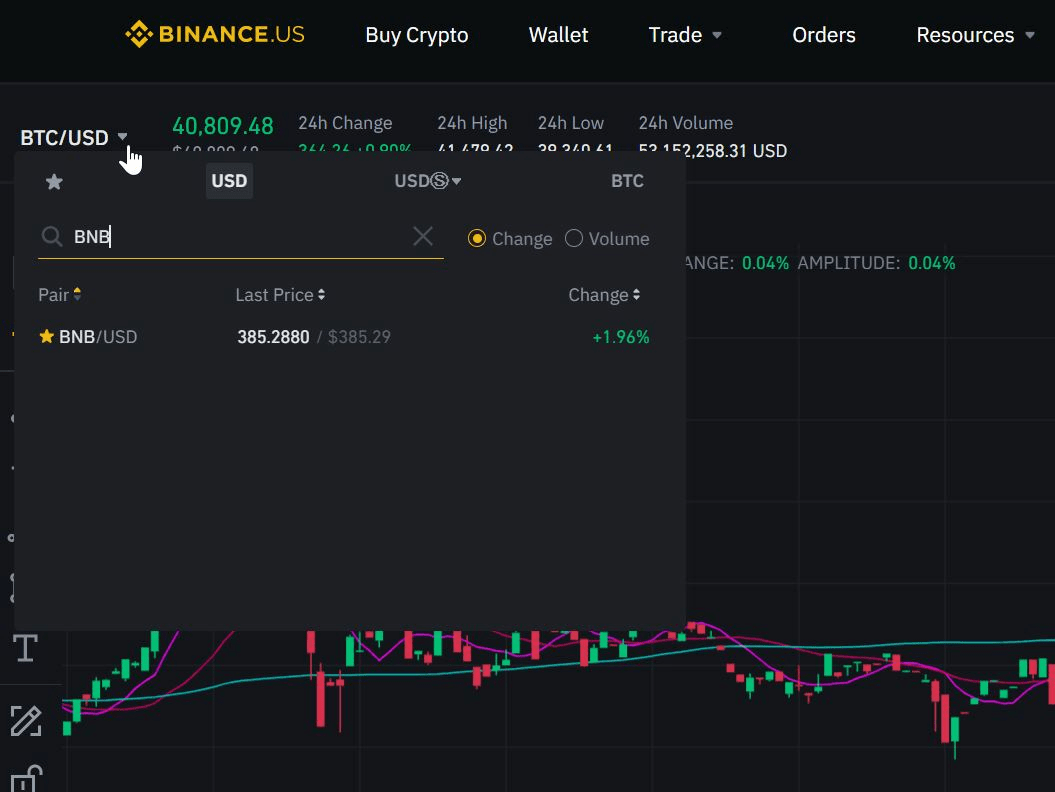

That will take you to the Bitcoin/USD exchange, so you need to switch it to BNB/USD. Click “BTC/USD” and type in “BNB” in the search bar, then click “BNB/USD.”

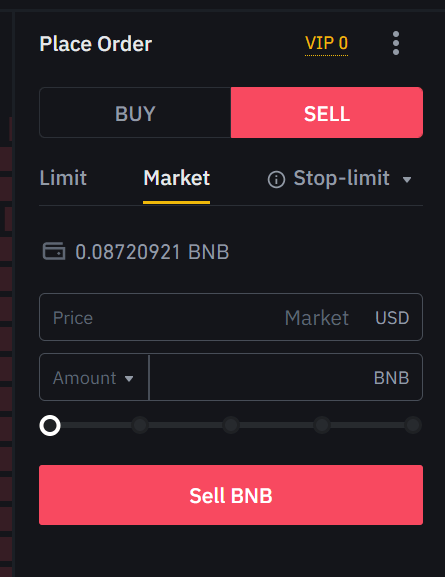

Follow the screenshot below to buy BNB at “Market” value.

If you understand “Limit” or “Stop-Limit” orders (same as with stocktrading), you can also do that instead of placing a “Market” order. The fees are the same (0.075 – 0.1%).

To learn more about those order types, read the official Binance explanation here: https://academy.binance.com/en/articles/understanding-the-different-order-types

ALTERNATIVE EXCHANGE TO GET BNB

If your local laws permit, you could buy BNB elsewhere, like KuCoin (my referral link: https://www.kucoin.com/ucenter/signup?rcode=rB9XSSM), but I prefer to buy it directly from Binance, the token creator itself.

Unfortunately, Kucoin.com doesn’t accept fiat money deposits, so you’ll need to first purchase USDT (a stablecoin pegged 1:1 to the U.S. Dollar) from another crypto exchange like Coinbase Pro (which doesn’t sell BNB), send that USDT to Kucoin, then swap it for BNB. It’s a huge headache with so many steps. Plus, you’ll incur extra transaction fees every step of the way and risk losing your coins forever if you make a misstep.

- It is CRITICAL that you buy BNB on the correct network, which is Binance Smart Chain (BSC, also known as BEP20). BSC and BEP20 are the same thing, so people use the terms interchangeably. You may see it written as “BEP20 (BSC)” or some variation thereof.

NOTE: Do NOT buy BNB on the Binance Chain (BEP 2). That doesn’t have the word “smart” in it. Also do NOT confuse BEP20 (the correct network) with BEP2 (the wrong one). Definitely do NOT buy BNB on the ERC20 network, which is the Ethereum network (they charge one of the highest transaction fees around). If you buy or send BNB on the wrong network, you will waste money converting your BNB to the proper network.

If you buy BNB from Binance.us or Binance.com, you don’t have to worry about choosing the right network. You won’t have a choice because the Binance exchange platform automatically picks the right BSC/BEP20 network for you. However, when you later transfer BNB out, you must ensure you’re selecting the BEP20 (BSC) network.

- Go to https://metamask.io/ and install the MetaMask extension for your Chrome, Firefox, Brave, or Edge internet browser. Sign up for a new account if you don’t already have one. You can also get the MetaMask Android app from the Google Play store or the Apple Store (coming soon). However, everything is much easier on the computer, which offers a better interface than the phone.

Detailed MetaMask set-up guide here (written by someone else): https://medium.com/@alias_73214/guide-how-to-setup-metamask-d2ee6e212a3e

The most important things to keep private are your MetaMask password (which you’ll pick yourself), and even more importantly, your MetaMask Secret Recovery Phrase (also called a Seed Phrase). You cannot pick your own seed phrase, and it can NEVER be changed. Keep this extremely private and protected. Do not give your Secret Recovery Phrase out to anyone, not even official MetaMask support people (they don’t need it). Anyone with your phrase can steal all of your cryptocurrencies. Anyone asking for your Seed Phrase is a scammer!

You MUST physically use pen and paper to write your Secret Recovery Phrase (Seed Phrase) down. Any form of digital record can be hacked (you’ll lose all your crypto), so NEVER save your Seed Phrase as a digital file or picture on your phone, computer, or cloud drive.

Do NOT write your Seed Phrase down around cameras, not even a webcam or phone cameras (cover those all up). NEVER type the Seed Phrase on your computer, tablet, or phone. NEVER use Google Docs, Microsoft Word, Notepad, or anything digital to record or store your Seed Phrase. NEVER use a password manager app. NEVER print out your Seed Phrase because printers keep records of what’s printed. Especially do NOT take a picture of your Seed Phrase with your phone/camera.

Some people worry that paper can get damaged/burned or that ink can fade, so they even use more permanent solutions like steel or titanium plates to record their Seed Phrases and store them in a safe or bank safety deposit box. These metal solutions are pretty expensive (around $25-50+ each), so think about how safe you want to be. But just remember, if you lose your Seed Phrase or anyone gets access to it, no one (not even MetaMask developers) can help you recover your wallet if your computer crashes/gets hacked. You’ll likely lose all your funds.

The Seed Phrase is stored locally on your own internet browser/computer, NOT on MetaMask servers. Technically though, because the Seed Phrase was generated online, it’s insecure if your computer has already been compromised/hacked.

Security Tip: I recommend using an offline physical hard wallet like the Keystone Pro (https://keyst.one/), which is 100% air-gapped, meaning it has no ability to connect to a computer or the internet. You can later sync your Keystone wallet to MetaMask. Hardware wallets are an additional cost and require extra steps, but they are far safer than MetaMask alone.

I do NOT recommend the popular Ledger or Trezor hard wallets (their screens are too small and Ledger even had a data breach). Ledgers are not even 100% air-gapped because they use Bluetooth. You have to weigh your own convenience versus security.

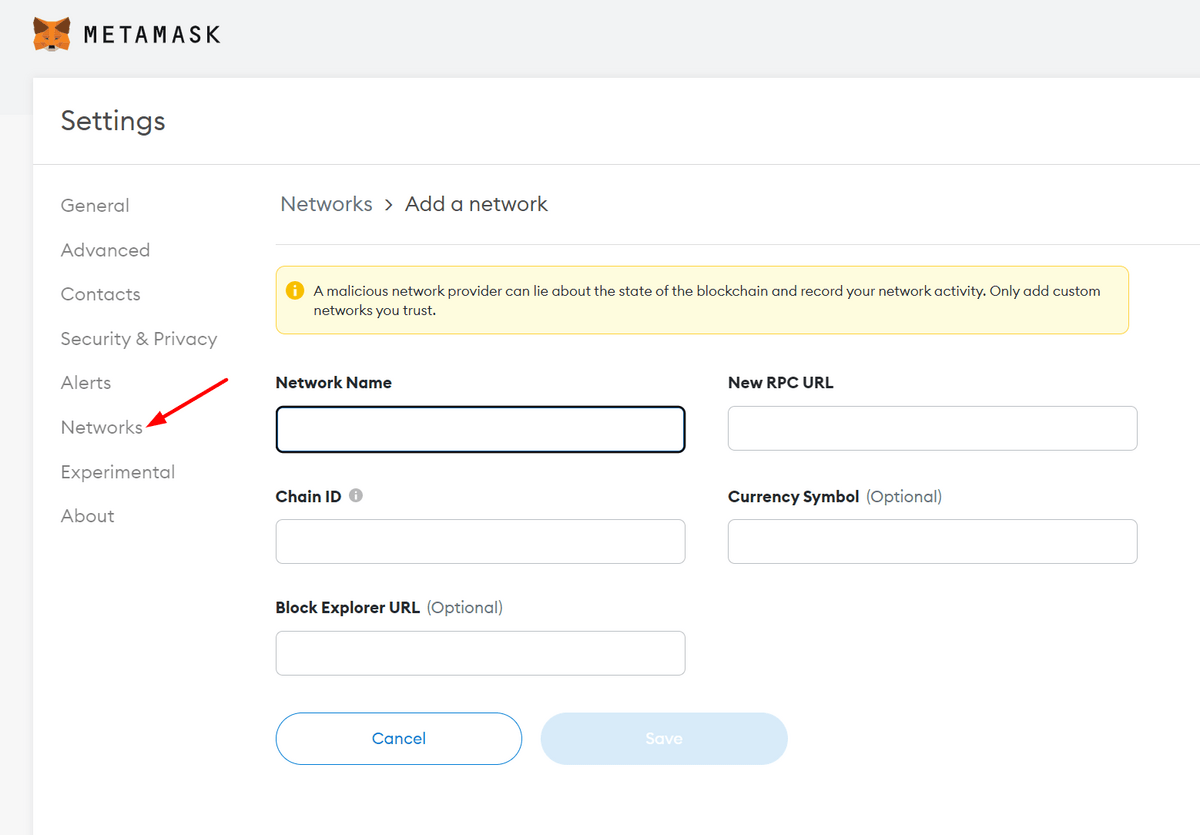

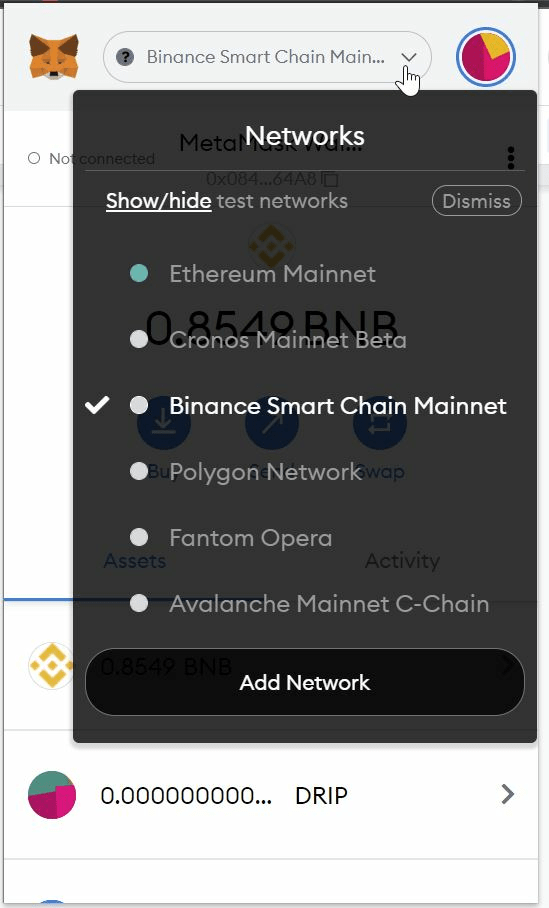

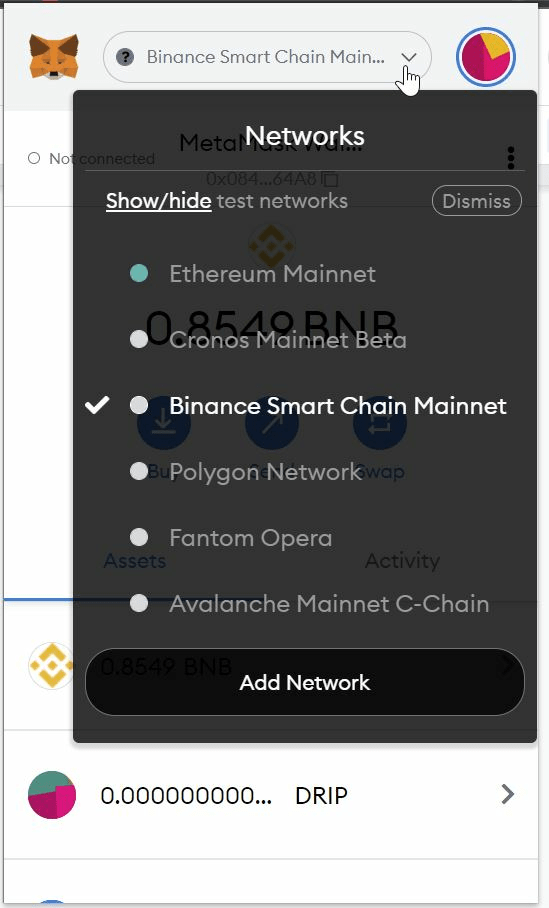

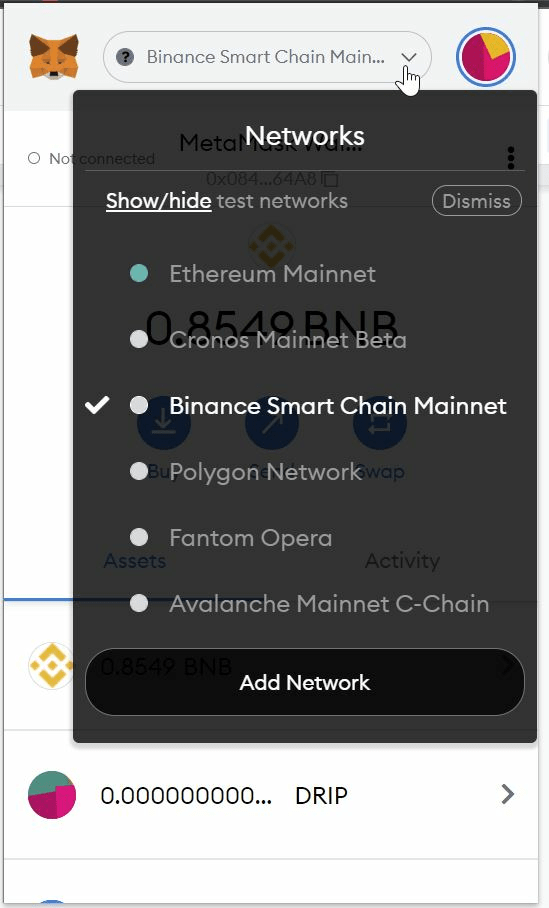

- Add the Binance Smart Chain (BSC/BEP20) network to MetaMask. Here’s a step-by-step guide from the official Binance site: https://academy.binance.com/en/articles/connecting-metamask-to-binance-smart-chain

Copy and paste the settings:

Network Name: Binance Smart Chain (BSC/BEP20)

New RPC URL: https://bsc-dataseed.binance.org/

ChainID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com

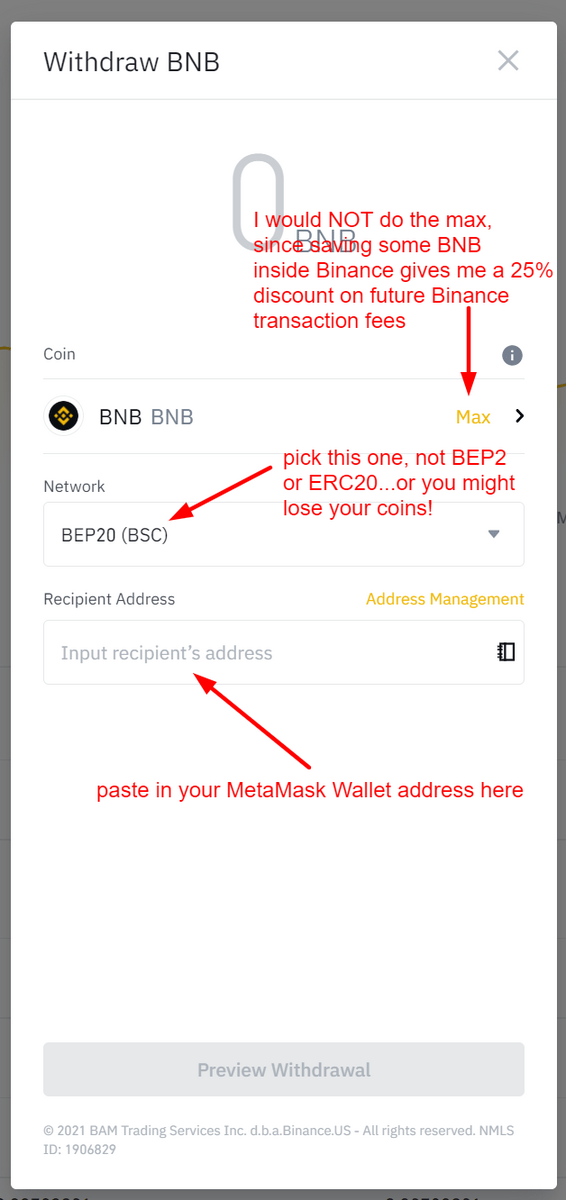

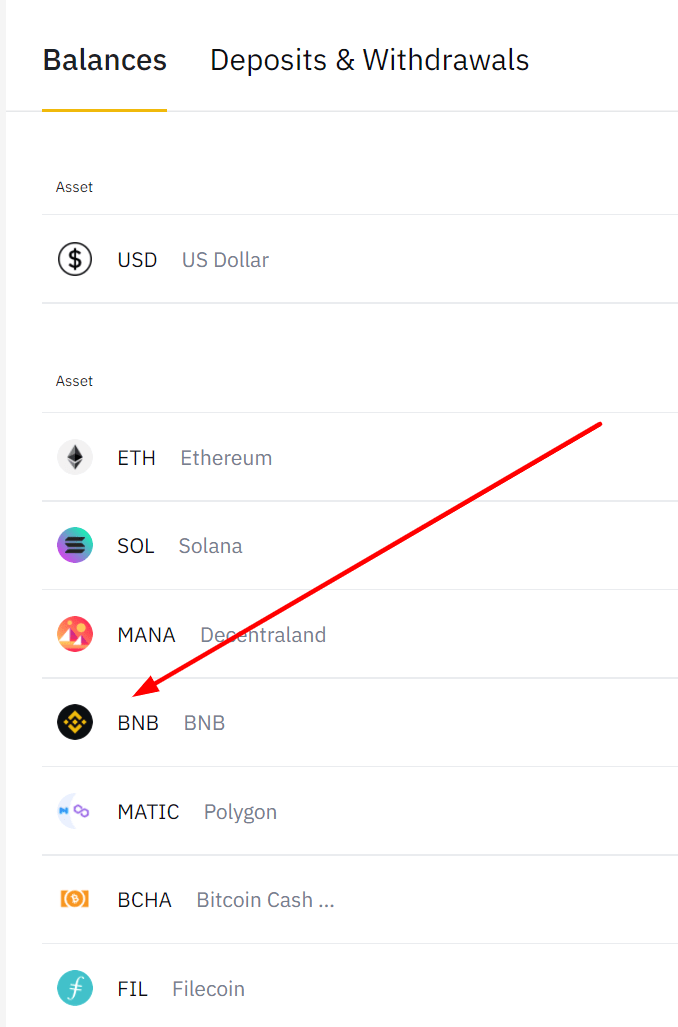

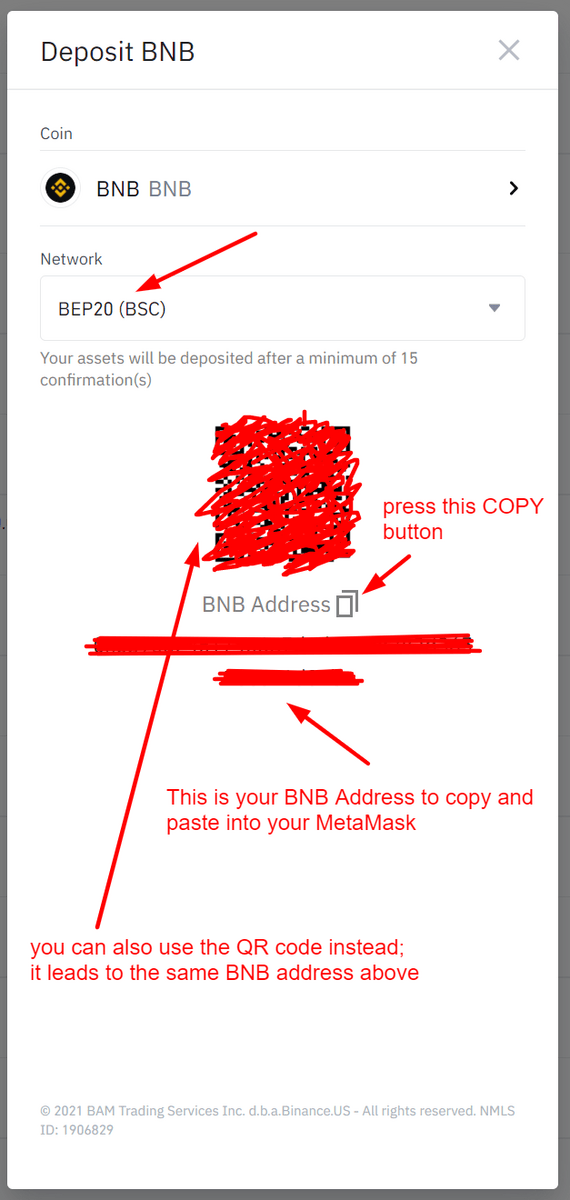

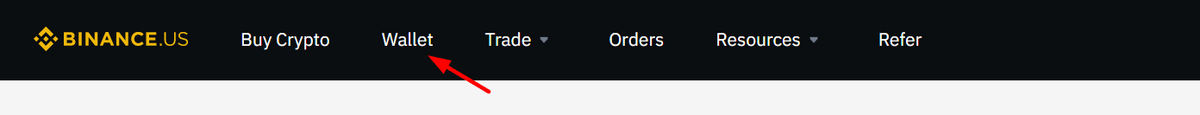

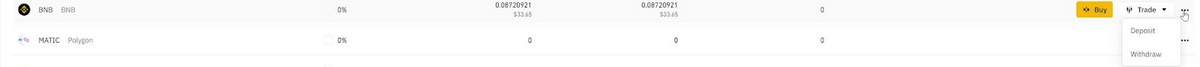

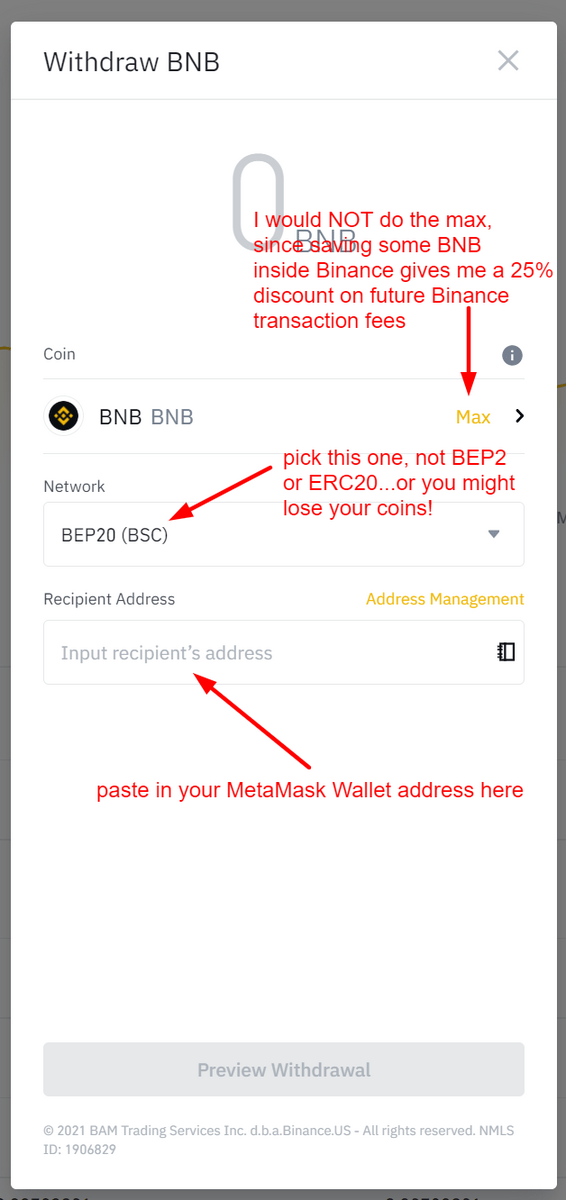

- Go to the Wallet tab on Binance to withdraw your BNB on the BEP 20 (BSC) network to your MetaMask Wallet address, which must be first connected on the BEP 20 (BSC) network.

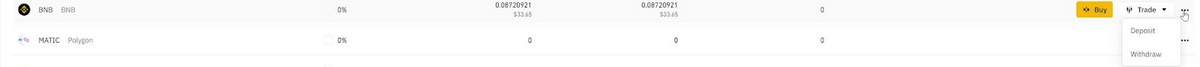

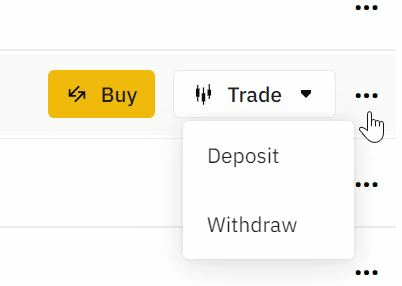

In Binance’s Wallet tab, look for the BNB row and move your mouse cursor over to three dots to make “Deposit” and “Withdraw” appear. Click “Withdraw.”

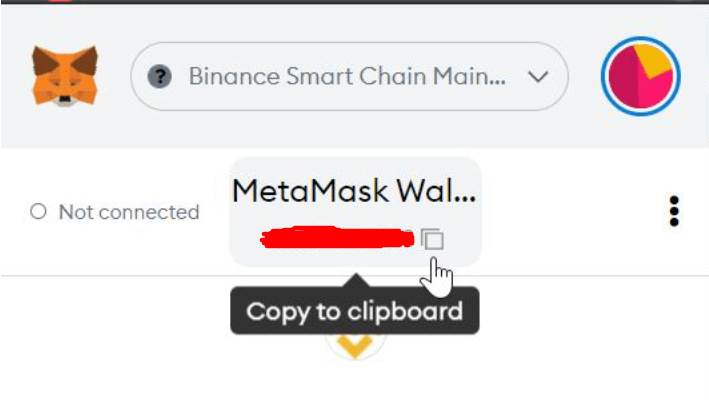

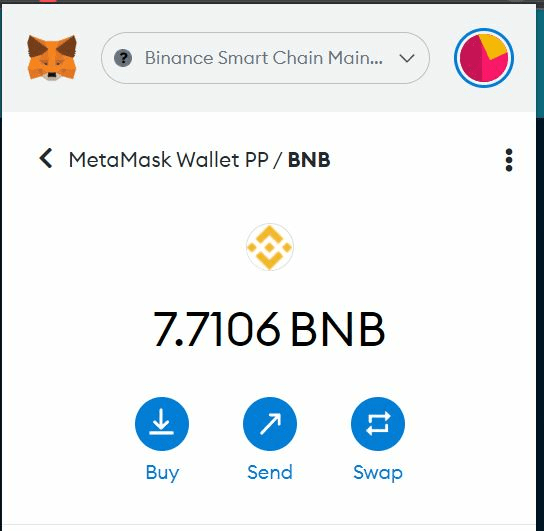

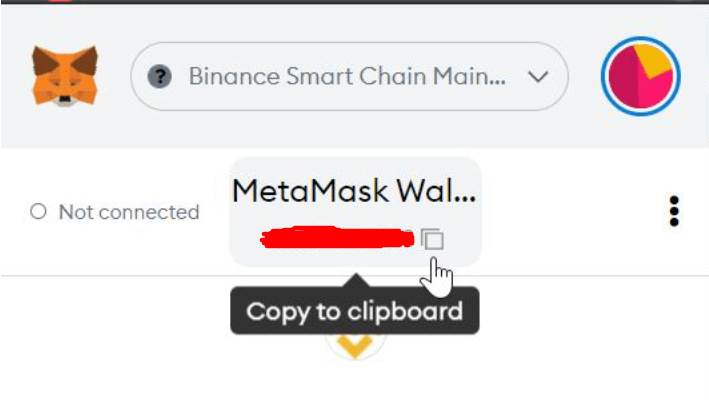

Open your MetaMask Wallet and make sure you select the Binance Smart Chain Network (or whatever you named it when you first added the BSC/BEP20 network).

Now copy your MetaMask address (see screenshot below) and paste that address into the proper “Recipient Address” box on in the “Withdraw BNB” pop-up box on Binance (see two screenshots above).

Do NOT transfer all of your BNB out of Binance because you need to save a small amount for transaction fees, known as “gas fees.” Usually, 0.05 – 0.1 BNB is enough for making a few transactions, though you may want to save more if you plan on making many transactions. You can always buy more BNB later too.

Don’t freak out if you don’t immediately see your BNB deposited inside your MetaMask Wallet, even if you’ve refreshed it several times. Transactions in the crypto world are not instantaneous and can take a few minutes (sometimes hours if the network is congested). However, BSC is pretty fast, so if you don’t see your BNB showing up within 5 minutes, there’s a good chance something went wrong.

If you’re using a hardware wallet like Keystone Pro or Ledger, then there will be different, more complicated steps, but if you’re an advanced user like that, you probably know what to do.

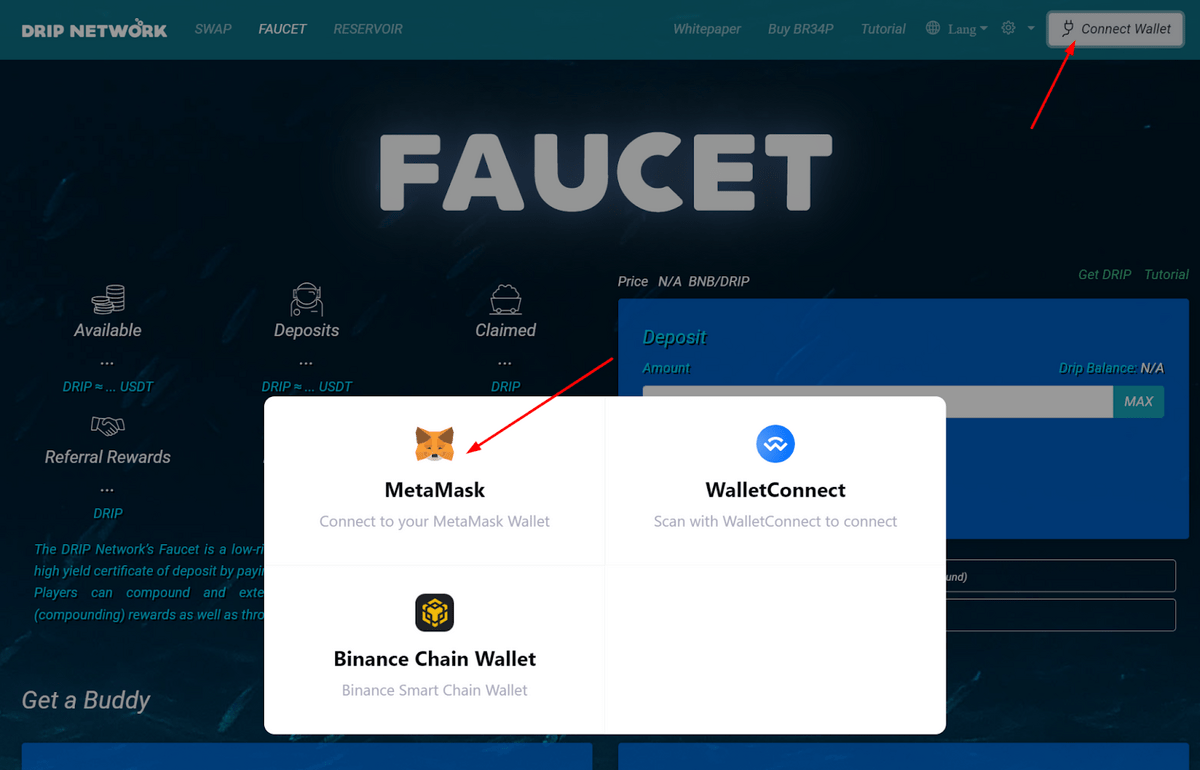

- After you see your BNB deposited in MetaMask, head to drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8 and click the CONNECT WALLET button at the top-right of the site.

Note: The screenshots in this article are for DRIP Version 1. Forex Shark is almost ready to launch Version 2 of DRIP’s user interface (UI), which looks much nicer, but that means the entire website look will be different. Look around for CONNECT WALLET.

After clicking CONNECT WALLET, you’ll see a pop-up with different wallets you can connect. Click MetaMask. You’ll see a pop-up MetaMask notification asking you to CONFIRM this transaction. Click CONFIRM. This allows DRIP to interact with the funds inside your MetaMask Wallet.

Note: If you see “Incorrect Network,” switch MetaMask’s network to the proper Binance Smart Chain (BSC/BEP20) network and connect again.

If you’re connected properly, the upper corner of the DRIP page will show your MetaMask Wallet address (this is public information, so anyone can see this address). The only things you must keep secret are your Seed Phrase and password.

- A buddy/referral address is required to join DRIP, so go to drip.community/faucet?buddy=0x084933793fA5885E0c684ee3BeA20dd9829D64A8 and click “Buddy Detected” under the “Get a Buddy” section. This which will auto-populate the Buddy Address field

Or you can manually copy and paste the following into the Buddy Address field:

0x084933793fA5885E0c684ee3BeA20dd9829D64A8

Now click UPDATE. A MetaMask pop-up notification will pop up, so click CONFIRM to pay a tiny transaction fee (a few cents) to sign up under the buddy address.

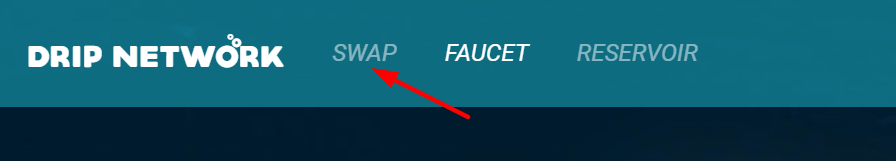

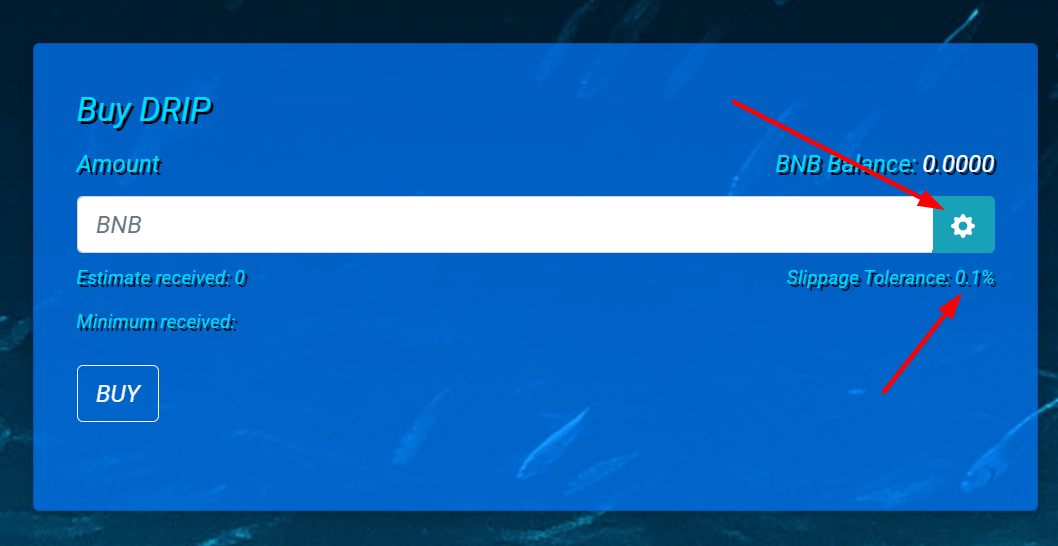

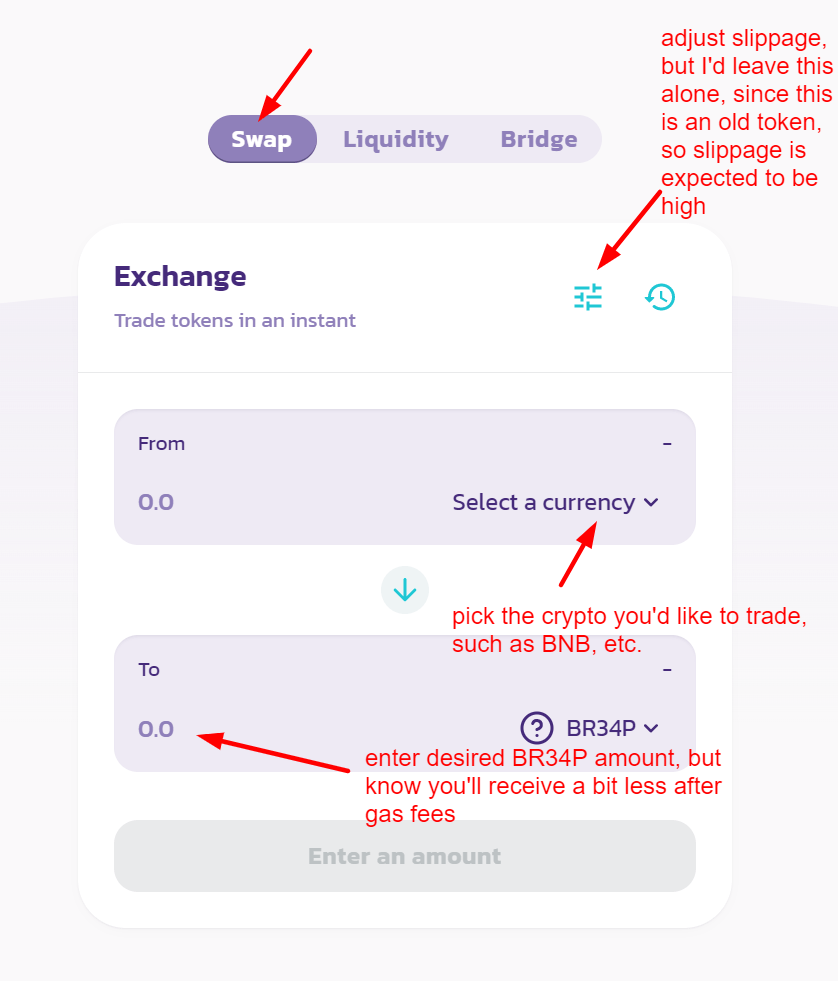

- Now you’re ready to exchange your BNB for actual DRIP. Click “SWAP” in the top banner of the DRIP page.

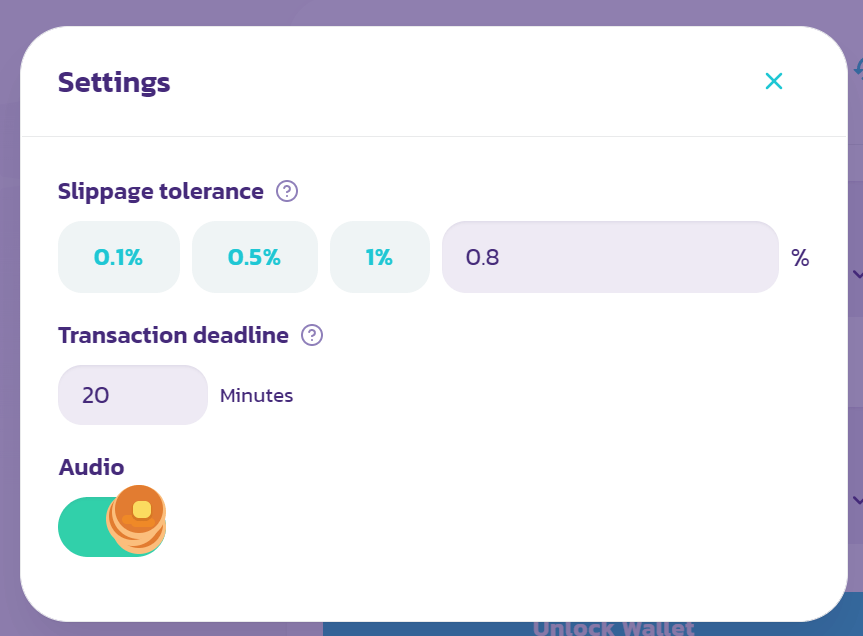

Then under the “Buy DRIP” box, click the gear icon to adjust the slippage tolerance. The slippage means how much fluctuating price changes you’ll accept from the listed price above the box. Higher slippage percentages are more likely to process the transaction successfully, but you may lose more money in the swap.

I like to use 0.25%, but the lower you go, the more likely you’ll get an error message on MetaMask that the transaction is likely to fail. If that happens, do NOT confirm. Reject, and adjust your slippage higher until the error disappears. You may need to go as 1.0%, or maybe even more depending on how much DRIP activity is happening at the moment.

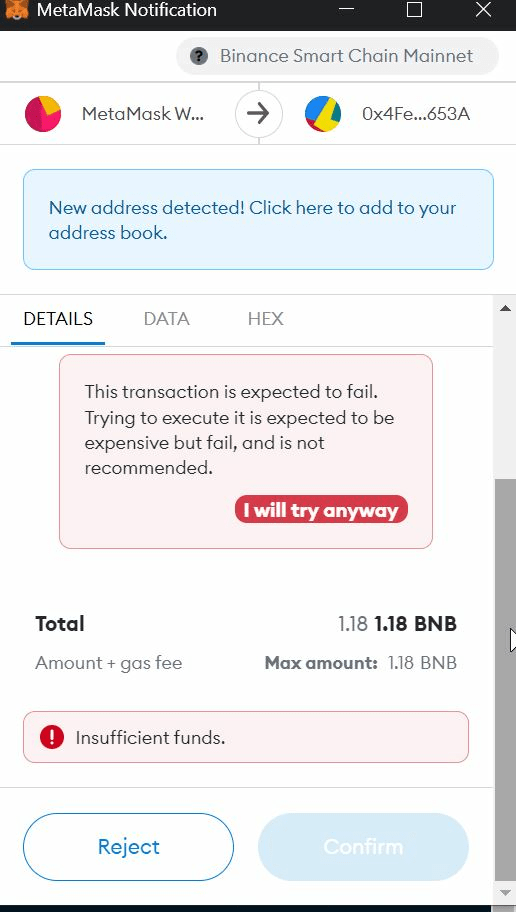

- Type in how much BNB you want to exchange for the DRIP token. Don’t input 100% of your BNB because you need to keep a small amount (recommended at least 0.1 BNB) inside your MetaMask to pay for transaction fees (called “gas fees”). Click BUY, then on the pop-up MetaMask notification, click CONFIRM to approve the purchase.Note: If you see a message that says the transaction is expected to fail, do NOT confirm. It usually means you’re trying to swap too few BNB, so increase your purchase amount. Or maybe you have insufficient funds, so add more BNB.

You might also see a MetaMask message that says a new address was detected, asking you to add it to your address book. This new address is the DRIP Faucet contract wallet address, so if it’s your first time interacting with DRIP, MetaMask doesn’t recognize the address.

If you add it to your address book, MetaMask will remember that it’s a trusted address, which you can label as “DRIP Faucet” or something. It’s up to you if you want to add it to your address book. It helps with identifying the contract address.

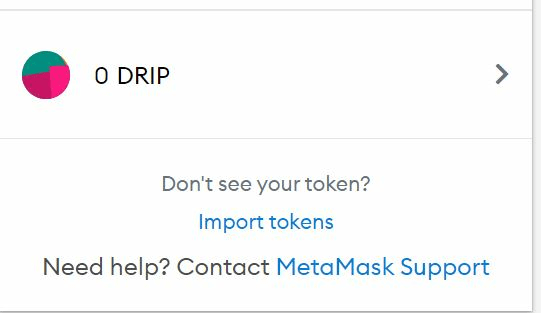

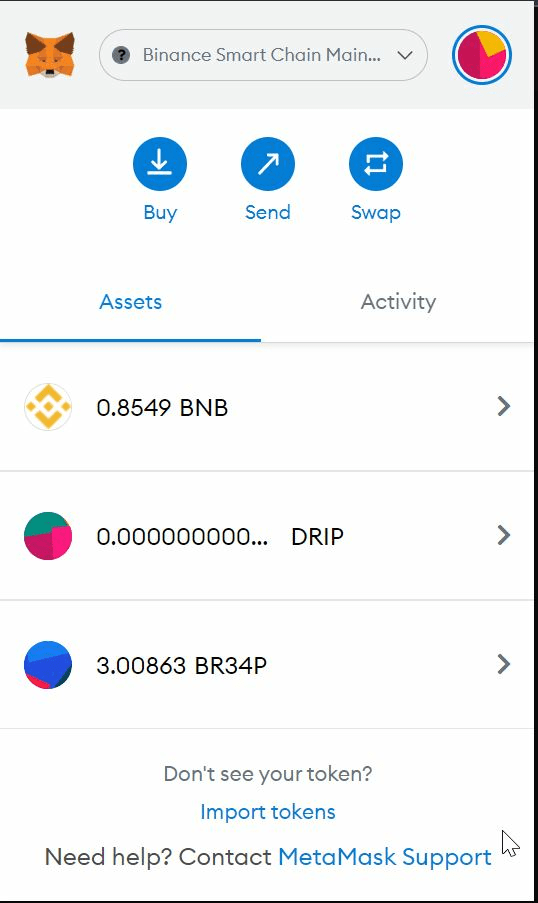

- Import the DRIP token into MetaMask, so you can actually see that you now own some DRIP. Without importing this custom DRIP token, you might think you just lost all your BNB and received no DRIP, when in reality, you just didn’t tell MetaMask to make the DRIP appear. To import DRIP, open your MetaMask extension and under your Assets tab, you’ll see your BNB. Scroll down a bit and you’ll see “Don’t see your token? Import tokens.” Click that.

Type in the following:

Token Contract Address:

0x20f663cea80face82acdfa3aae6862d246ce0333

Token Symbol:

DRIP (this should auto-populate; otherwise, type in “DRIP”)

Token Decimal:

(this should auto-populate; otherwise, type in “18”)

The warning about fake versions of existing tokens is just letting you know not to import from contract addresses that you don’t know/trust. The one I listed above is the only correct DRIP token contract address.

Click the blue “Add Custom Token” button. Your newly purchased DRIP tokens should appear within a few moments inside MetaMask.

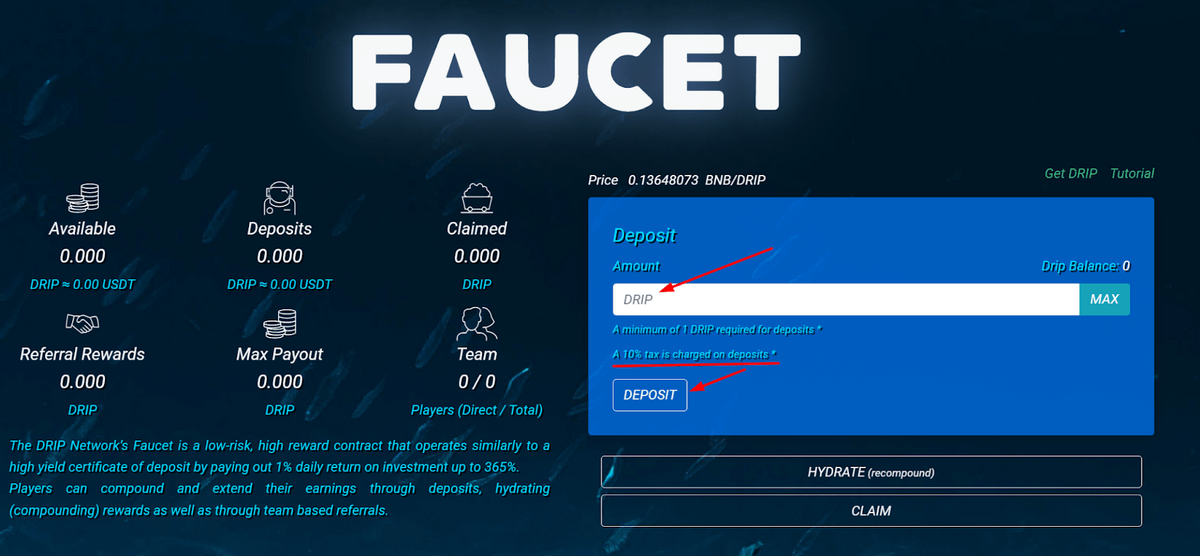

- In the Deposit box, type in how much DRIP you want to invest. I’d click MAX to put in 100% of your DRIP, unless you want to save some DRIP to invest in other DeFi projects like the DRIP Garden or Piggy Bank (which I won’t talk about in this article). Click DEPOSIT (current minimum deposit is 1 DRIP). Click CONFIRM on the MetaMask pop-up notification to approve the transaction and pay the gas fee.Normally, everyone depositing is charged a 10% deposit tax. But if you’ve joined with my referral link, 25% of that tax is automatically returned to you as an airdrop (free gift), so you’d only effectively pay a tax of 7.5%. Only special Team Wallet referral links like mine offer this discount. On top of that, I also offer additional free DRIP as a welcome bonus for everyone using my referral link.

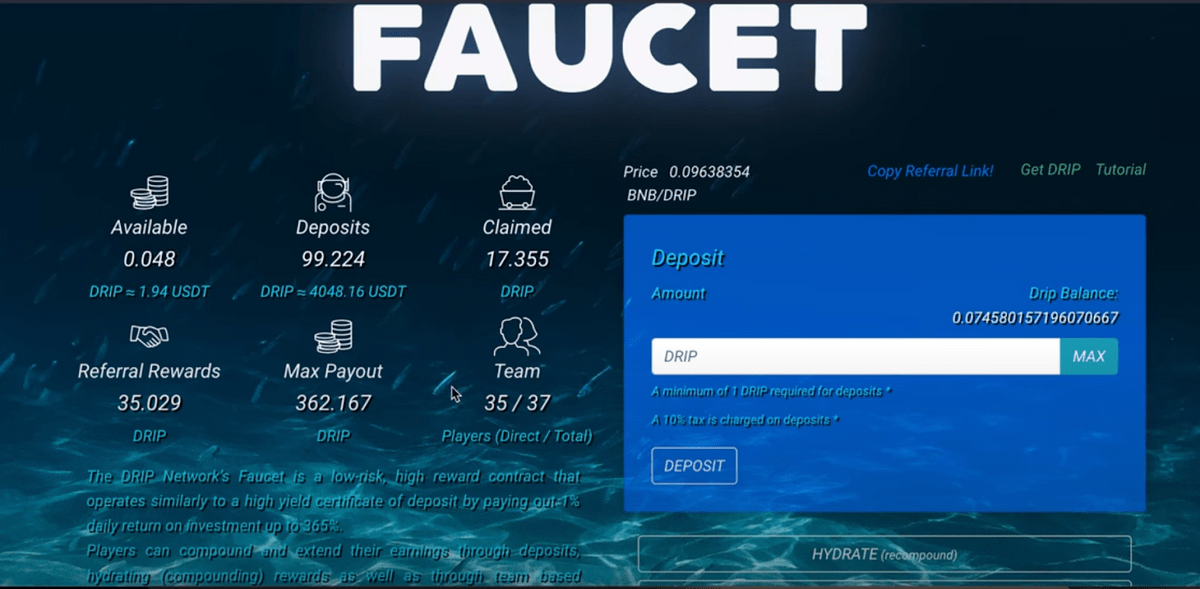

- That’s it! You’re invested. Your full deposit is burned, so you cannot get that back, but you’ll immediately start earning 1% per day on the deposited amount shown in the DRIP dashboard. Remember, this amount is post-deposit tax, so it’ll be less than your actual deposit.

Keep in mind, your DRIP rewards are stored at the DRIP Faucet contract address, not your own MetaMask Wallet until you claim your DRIP (10% claim tax). That means you won’t see your DRIP balance go up inside MetaMask unless you’ve already claimed the rewards. Hydrations are charged a 5% tax.

All of these taxes are counted towards your max payout of 100,000 DRIP per wallet, but you probably haven’t deposited enough to see 100,000 displayed yet. The more you deposit, hydrate, and receive airdrops, the more your displayed Deposits increase, which then increases the Max Payout displayed. The displayed Max Payout is always 3.65x (365%) your displayed Deposits until you reach the hard cap of 100,000 DRIP.

- Now it’s up to you to decide a personal strategy to either HYDRATE (compound) or CLAIM your rewards every day. Technically, you could click those buttons anytime, even multiple times per day, but you need to take transaction fees into consideration and optimal strategies. I’ll cover some popular strategies to help you determine the best hydrate/claim schedule for your personal situation in a following section below.

- To turn your DRIP rewards back into regular cash (fiat money), you’ll need to first convert it back into BNB, which you can then deposit back into Binance.us or Binance.com or another crypto exchange platform that lets you swap BNB for USD (or another fiat currency or cryptocurrency if you prefer).

Make sure you’ve first claimed your DRIP into your MetaMask Wallet. Then go to https://drip.community/fountain, and under the SELL DRIP box, adjust the slippage tolerance to your preference. You don’t have to click their suggested values. I prefer typing in a smaller amount like 0.1% slippage.

Then type in the amount of DRIP you want to sell and click SELL. Click CONFIRM on the MetaMask pop-up notification. You’ll also need to toggle the Approve DRIP button and click CONFIRM on the MetaMask pop-up, which will cost a small transaction fee (a tiny bit of BNB). Remember, selling DRIP costs a 10% sell tax, so you’ll only receive 90% of your DRIP back into MetaMask. All these taxes help keep DRIP Faucet sustainable.

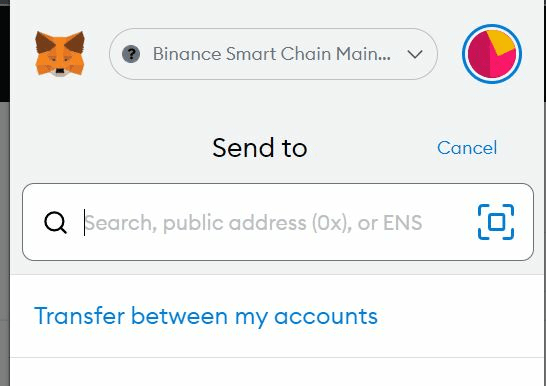

- After you see your DRIP tokens show up in your MetaMask Wallet, click the Assets tab, click BNB, then click the blue Send icon to send BNB to Binance.us or Binance.com.

- In the “Send to” box in MetaMask, paste in your Binance wallet address where you’ll receive your BNB. You can find your Binance wallet address under the Wallet tab on the Binance site.

Locate the BNB row and click on the 3 dots (far-right of the screen, next to the “Trade” button), then click “Deposit,” which will display your BNB address. The QR leads to the same BNB address.

Choose the BEP20 (BSC) network or your money might disappear (or need to be retrieved in complicated ways, which cost fees)!

Click CONFIRM on the MetaMask pop-up notification to approve the transaction and gas fee. In a few moments, your BNB will be deposited into your Binance Wallet.

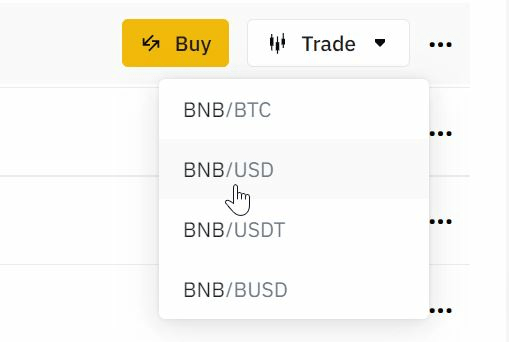

- Now inside Binance, under the Wallet tab, identify the BNB row. Click on “Trade” and you’ll see a dropdown menu appear, showing you that you can trade your BNB for USD (or a few stablecoin options like USDT or BUSD, or even Bitcoin.) If your goal is to have regular cash, click the BNB/USD pair.

- This will take you to the trading tab, where you can execute a limit order, market order, or stop-limit order. To learn about order types, read the Binance explanation: https://academy.binance.com/en/articles/understanding-the-different-order-types

Click the red “Sell BNB” button to execute, and after it succeeds, you now have regular USD inside your BNB Wallet. Congrats, you’ve realized your profits in regular cash!

- Now you can transfer USD back to your bank, but I recommend keeping at least some inside Binance, so you can deploy that cash for future crypto investments. If you withdraw it back to your bank, then redeposit USD later for future crypto plays, you’ll need to wait 10 days before Binance allows you to transfer your money or newly purchased crypto out to an external wallet address like MetaMask, which is needed for many DeFi investments.

In 10 days, prices can change dramatically, so you might miss out on good opportunities. I learned that the hard way, so now I like to keep some USD or stablecoins inside various centralized crypto exchanges (CEX) or non-custodial wallets like MetaMask to instantly deploy without a waiting period. There are pros and cons of keeping your coins inside CEXs versus non-custodial wallets, so do your own research to make that decision.

But keep in mind the saying “Not your keys, not your coins.” You don’t have the keys to a CEX wallet, but you do own the keys (your Seed Phrase) to MetaMask, so the question is who do you trust more with handling security: the CEX with a dedicated security team (though many have still been hacked) or yourself? There are also gas fees to transfer crypto from your wallet to a CEX, where you can more easily trade/sell, so also consider those fees.

How to Top Off Gas (BNB Fees) in MetaMask

You need to always maintain a small amount of BNB within your MetaMask Wallet (specifically in the account you used to sign up for DRIP) to pay for every transaction. Every crypto transaction, not just in DRIP, requires a separate gas fee. You need to top off your gas BEFORE trying to carry out your transactions!

It’s critical to plan ahead to replenish your BNB because there’s a 10-day waiting period inside Binance before you can transfer out the BNB to MetaMask. In that time, you can’t do anything in DRIP if you can’t afford the gas fees. You’re losing all your compound/claim days. Furthermore, the price of BNB and DRIP may fluctuate dramatically while you’re waiting.

So what do you do if you’re running low on BNB for gas, or you get a message in MetaMask that says the transaction is expected to fail (which typically means your desired action will NOT be executed, but you will still lose the gas fee)?

You buy more BNB by going toBinance.us or Binance.com, and remember to toggle on the setting that lets you save 25% on purchase fees by paying with BNB instead of fiat money.

I recommend keeping $20-50 USD worth of BNB inside Binance.us or Binance.com at all times to cover purchase fees, but the exact amount is up to you.

Inside Binance.us or Binance.com, click the “Wallet” link in the top banner.

Find the USD (US Dollar) row, and scroll your mouse cursor to the right side of the row until “Deposit” and “Withdraw” appear.

Click deposit to transfer fiat money from your bank (ACH transfer or wire) into Binance.

It may take a few moments for your money to appear inside Binance, but once it does, you’ll wait 10 days to transfer it out to MetaMask. Unfortunately, Binance makes you wait these 10 days to avoid chargebacks, so you cannot transfer out your newly deposited fiat money (or BNB, or any crypto, purchased with it) immediately.

That’s a lesson I learned the hard way, so I now leave some USD that has vested for 10+ days inside Binance to deploy whenever I want without a waiting period (and I’ll replenish it asap if I do transfer it out).

Alternatively, you can keep some stablecoins (cryptocurrencies like BUSD, USDC, USDT, etc. which are pegged 1:1 in value to USD), but they also need to be vested for 10 days if you just purchased them with newly deposited fiat money.

When your 10 days are up, follow the screenshot below to buy some BNB the same way you originally bought BNB.

Option 1: Instant buy with the “Buy Crypto” button seen below) costs 0.5%.

Option 2: Spot Trading under the “Trade > Advanced Trading” section) is cheaper at 0.075 – 0.1%.

After purchasing some BNB, you need to withdraw it on the BEP 20 (BSC) network to transfer to your MetaMask Wallet address, which must be first connected on the BEP 20 (BSC) network.

Open your MetaMask Wallet and make sure you select the Binance Smart Chain Network (or whatever you named it when you first added the BSC/BEP20 network).

Now back in Binance’s Wallet tab, look for the BNB row and click the three dots on the far right to make “Deposit” and “Withdraw” appear. Click “Withdraw.”

Copy your MetaMask Wallet address (see screenshot below) and paste that address into the “Recipient Address” field in the “Withdraw BNB” pop-up on Binance (see screenshot above).

Do NOT transfer all of your BNB out of Binance because you need to save a small amount for transaction fees, known as “gas fees.” Usually, 0.05 – 0.1 BNB is enough for making a few transactions, though you may want to save more if you plan on making many transactions.

If you don’t immediately see your BNB deposited inside your MetaMask Wallet, don’t worry. Transactions in the crypto world can take a few minutes (sometimes hours if the network is congested). BSC is pretty fast though, so if you don’t see your BNB showing up within 5 minutes, there’s a good chance something went wrong.

If you followed the steps right, you should see more BNB inside your MetaMask for gas now though!

Note: You could trade other cryptocurrencies (instead of newly deposited USD) for BNB too. If those cryptocurrencies were NOT bought with newly deposited USD, you can swap to BNB and immediately withdraw out to MetaMask—even if you just deposited those cryptocurrencies into Binance from a different wallet or exchange a few seconds ago.

Is DRIP a Ponzi/Pyramid/MLM Scheme?

When most people learn about DRIP, they immediately think Ponzi scheme because a buddy/referral link is required to participate. But this referral link operates much more like a traditional affiliate link, which rewards both you and your referrer with extra bonuses (free DRIP). It’s like those websites that offer a $10 free bonus to each new sign-up, as well as $10 to the person who referred the newcomer.

But true Ponzi schemes are designed so that new sign-ups are only able to earn by recruiting more referrals. That’s why Ponzi scheme investors who get in too late have no chance of making money and often lose their entire investment.

This is absolutely NOT the case with DRIP. Even if you refer nobody, you’re still entitled to earn the 1% daily compounded interest promised to every DRIP investor—no more, no less. That’s completely fair.

Now, if you choose to refer people (the operative word is choose, because you really don’t have to), then you can earn extra reward bonuses on top of your incredible returns of the core DRIP product.

In fact, in some sense, DRIP’s design actually discourages referrals by reducing the rewards a referrer earns once he gains 5+ direct referrals. Getting 5+ referrals automatically classifies the referrer’s wallet as a Team Wallet, which lowers the referrer’s own reward percentage, while simultaneously increasing the rewards to his referrals.

Doesn’t that sound like the OPPOSITE of how Ponzi schemes function (normally, you’d think the more referrals you bring in, the higher the rewards you’d earn from them)?

But DRIP does things differently. These counterintuitive mechanisms are precisely what have kept DRIP sustainable for a year (an eternity in the crypto world, where most projects collapse in 1-3 months with many investors losing all their money).

NOTE: Earning referral bonuses does NOT increase your maximum earning potential. Everyone, regardless of their referral count (even people with 0 referrals), has the exact same max payout: 100,000 DRIP (before DRIP taxes). Wallets are programmed to stop earning anything once they reach that payout.

That means people earning massive referral bonuses simply reach this max payout sooner because they have a higher amount to compound with. However, given enough time, even people with no referrals can compound enough to earn the same max payout. Everyone ends up earning the same amount of DRIP if they continue to the max payout.

Now some people argue that the high taxes keeping DRIP sustainable are paid for by new investors piling on, which is true. But taxes are also paid by old/current investors. Everyone pays them.

Sure, if suddenly no one invested any further into DRIP, then the project becomes a closed system where the people cashing out are taking money from the others. That’s the big fear many investors worry about. But that’s how the traditional stock market (and ALL of economics) works too!

What causes the share prices of TSLA or AAPL or AMZN to go up? More people investing. If suddenly everyone stopped investing in those stocks and people only sold, then you have the same situation as the dreadful DRIP scenario above: people cashing out are earning their profits from the money from the other investors who previously bought the shares.

So you believe DRIP is a Ponzi, then by that same logic, you believe the stock market and entire economic system at large are also Ponzis. They all require more capital flowing in to boost the current price of stocks or everyday items like gasoline or milk. People buying the same thing at higher and higher prices creates natural inflation. I mean, are you paying the same for gasoline as you did a few years ago? This mechanism is a natural part of economics, not a Ponzi scheme.

The good news is that there are tremendous incentives for people to continually invest in DRIP. Not only are DRIP investors who’ve already reached their max payout re-investing in DRIP by starting new wallets, but there are multiple reasons people are buying DRIP for other projects in the DRIP Network ecosystem.

Forex Shark, the DRIP developer, also created Animal Farm, Piggy Bank, and other projects that require DRIP tokens, so there will always be people buying the DRIP tokens you want to sell unless the entire ecosystem fails. The livelihood of the DRIP Faucet doesn’t just rely on itself, which is already quite sustainable alone, but it’s further sustained by the other DRIP Network projects.

This multi-support ecosystem is why I believe so much in DRIP. And for further assurance, Forex Shark is currently pursuing partnerships with huge exchanges like Pancake Swap and others to create actual utility for the DRIP token. Soon, DRIP won’t just be a meaningless token, but something with actual value and usefulness like ETH. All of this means the price of DRIP is likely to go up long-term.

In conclusion, unless you believe economics at large is a Ponzi, then DRIP is 100% NOT a Ponzi scheme either—everyone is treated equitably, no matter which position they hold on the ladder or how many referrals they’ve recruited.

Whale Tax Explained

A “whale” is someone who holds a large amount of crypto. The danger of a DRIP whale is that he/she can sell huge amounts of DRIP at once, significantly affecting the balance of supply and demand. If a whale sells, DRIP’s price will drop significantly because the large DRIP supply being offered for sale decreases demand, which in turn, lowers the price.

In most other DeFi projects, early investors DeFi often become whales by accumulating massive rewards early. When these whales later sell, it’s to the detriment of the whole ecosystem, particularly later investors who bought the tokens at a high price, only to see the token’s price plummet. This is why it’s so important to do something to limit the amount of sell pressure (and lower price action) that whales can create.

DRIP handles this problem by implementing an ingenious “whale tax” protection that helps maintain the DRIP Faucet’s sustainability. When price is falling like a rock, investors become scared to buy, which in turn, creates even greater desire to sell all around, thereby creating a death spiral as the price plummets towards zero. When people are scared to buy, liquidity also becomes a problem, meaning it’s difficult for someone wanting to sell their DRIP to exchange it for BNB and ultimately fiat money.

DRIP’s whale tax ranges from 5% to 50% on top of all other taxes in the DRIP system, which are as follows:

- 10% buy tax (if purchased from Pancake Swap, so avoid this by buying directly from the DRIP Fountain).

- 10% deposit tax (lowers to 7.75% if you sign up under a Team Wallet)

- 5% hydration tax (lowers to 3.8125% if you sign up under a Team Wallet)

- 10% claim tax

- 10% sell tax

- 5 – 50% whale tax

This whale tax goes directly to the rewards pool to ensure the whale can’t sell the full amount of DRIP he/she earned, thus reducing the sell pressure and downward price action.

From DRIP’s whitepaper, we can see the whale tax tiers as follows:

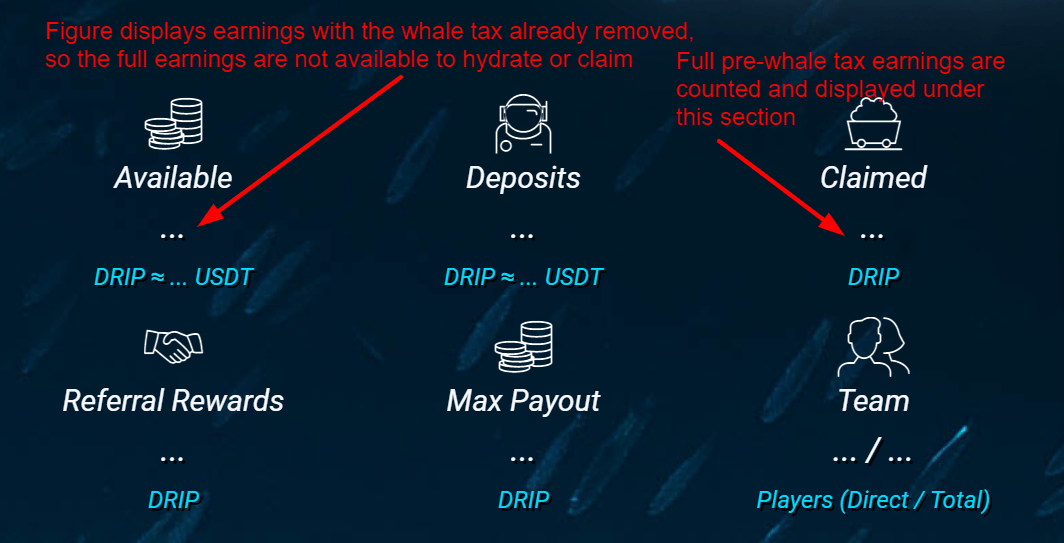

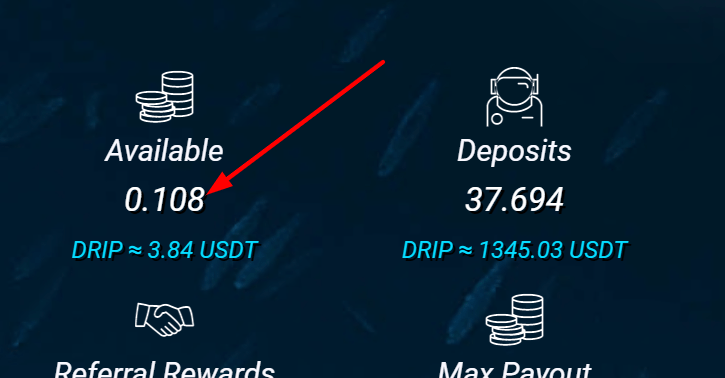

So the whale tax starts applying when the figure shown under “Deposits” (that’s the sum of the DRIP you deposited POST-deposit tax + hydrated POST-hydration tax + received via airdrops) reaches 1% or more of DRIP’s total supply.

Currently, the total DRIP supply is 1 million tokens, so 1% of that is 10,000 DRIP tokens. If there ever comes a case that more DRIP tokens are minted, then you’ll need more DRIP to reach 1% of the total DRIP supply.

So let’s pretend a whale has 10,000 DRIP under “Deposits.” Normally, he/she is supposed to earn 1% of that (100 DRIP) per day, which would show up as an extra 100 DRIP under “Available.”

However, with the whale tax, he just reached the 5% whale tax tier, which means only 95% of that earnings (so 95 DRIP, not 100) will appear under his “Available” to hydrate/claim section. However, the full pre-whale tax earnings (100 DRIP) will be added under the “Claimed” section once the 95 DRIP from “Available” is either hydrated or claimed.

In summary, the amount under “Available”:

- Has ALREADY removed the whale tax, even before you click “HYDRATE” or “CLAIM”

- Has NOT removed the 5% hydration tax (or 3.8125% if you signed up under a Team Wallet)

- Has NOT removed the 10% claim tax (or 7.75% if you signed up under a Team Wallet)

- Has NOT removed the 10% sell tax (since you haven’t even claimed the DRIP yet, much less sold it yet)

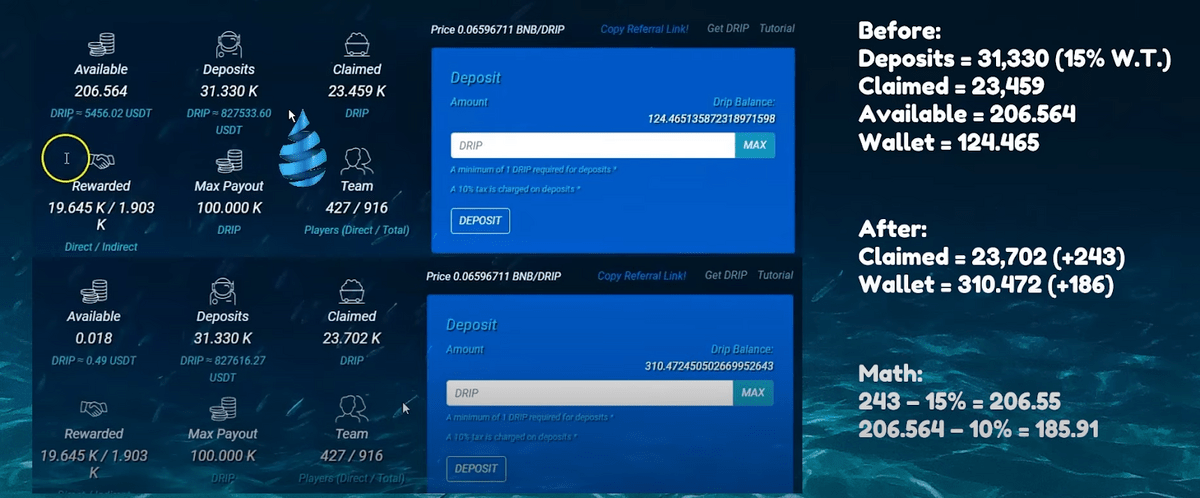

Let’s take a look at Stunna Breezy’s account, which was the first person to ever reach the max 100,000 DRIP payout, which occurred in February 2022. The top part of the screenshot shows his stats right before claiming, while the bottom half shows the results very soon after claiming.

At this point, Stunna Breezy already had 31,330 DRIP deposited. 1% daily interest of that is 313.3 DRIP, so he’s actually claiming before his full 24 hours is up. But it doesn’t matter; we can still see how the whale tax works.

Keep in mind the 23,459 DRIP he has already claimed previously. This number will increase after he clicks “CLAIM” to take his 206.546 DRIP earnings shown under “Available.”

After claiming, notice how his “Claimed” number jumped to 23,702 DRIP. That’s an increase of 243 DRIP claimed. But wait, didn’t he only have 206.546 DRIP “Available” to claim? So how come the “Claimed” figure jumped up higher than 206.546?

That’s because the whale tax was already taken out, so the figure shown under “Available” is POST-whale tax. His deposits are 31,330 DRIP, which puts him at the 15% whale tax tier.

The full claimable rewards he was trying to claim was 243 DRIP (which is what we see added under his “Claimed” section after clicking “CLAIM”). After the 15% whale tax, he keeps 85% of 243 DRIP = 206.55 DRIP (very close to the 206.564 shown!). The small difference is simply because the dashboard rounds off numbers for convenience, but rest assured, exactly 15% was taken for the whale tax.

Remember, there is also a 10% claim tax, so since he is claiming 206.564 DRIP, he will only receive 90% of that into his MetaMask Wallet.

Before claiming, we see his wallet balance for DRIP was 124.4651 or so. After claiming, we see it jumped up approximately 185.91 DRIP to 310.47245 DRIP or so.

Why only 185.91, not the full 206.564? Because 90% of 206.564 = 185.91 DRIP!

Important: the 10% claim tax is calculated off the “Available” to claim figure (which is POST-whale tax), NOT the full 1% daily earnings that gets added under “Claimed.”